This weeks report focuses on the economic recovery of the Eurozone, China and Russia. The current problems in these economies are still not resolved but at least for Russia and China there is a silver lining on the horizon. Russia’s pipeline with Turkey is moving ahead creating an alternative to the current transit route through Ukraine.

„Chinas economy unlikely to have hard landing“, WEF report.

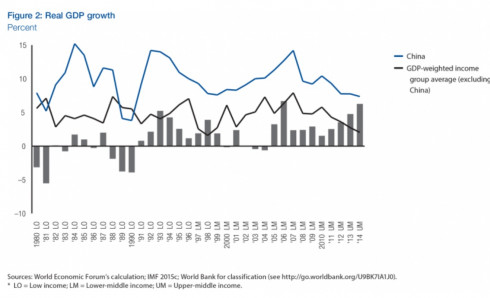

A recent report by the World Economic Forum in Switzerland gave insights into the forums expectations about the future of the Chinese economy. The authors expect great challenges and a certain downside risk but consider it unlikely that the economy will see a hard landing. The analysts of the WEF see the imminent slowdown of growth as inevitable as the country has seen a great growth trajectory over the past two decades. Some corrections on the Chinese markets are now necessary to prevent the establishment of a growth bubble (a positive market development that is driven by speculation instead of substantial economic reasons and therefore destined to burst causing devastating market turbulences and investment shortages). “There are signs that the government has been preparing for the economy’s new phase and has been recalibrating its growth objectives from the quantitative to the qualitative,” the report said.

Russia and Turkey to close the deal for the construction of Turkish Stream

The negotiations for the construction of the underwater gas pipeline are about to be finalized, Russia’s minister for energy said on Saturday. He expects the deal to be signed in either December 2015 or January 2016. The pipeline is intended to ensure the stability of gas supply to the European heartland, circumventing politically unstable countries like Ukraine. Russia has in the past greatly diversified its means of transporting its gas into the EU. The most famous project in this regard is Nord-Stream, a pipeline that connects Germany and Russia directly. The diversification of the gas pipeline infrastructure across multiple countries has several benefits. The delivery of gas is substantially cheaper due to a decrease in transition costs which amount to billions. The seconds reason is that diversification leads to a limited power the transition countries have. Several countries including Ukraine and Poland have used their status as transition country to halt gas flows into the EU, with Ukraine even stealing gas that was intended for other countries.

Secret bailout within the EU still on-going

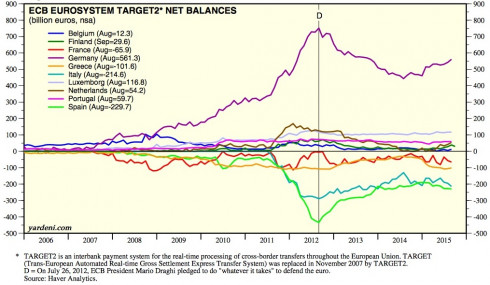

The secret bailout that is happening within the Eurozone is still on-going and still on a critical level. This bailout is happening through the target2 system, which was initially introduced as an interbank payment system where every national central bank would have an account which would balance to zero after every trading day. During the heights of the financial crisis these account balances climbed to several billion euros. As the graphic shows, the northern countries have positive nets while the southern countries have negative nets. This system can bee seen like having a tab at a bar, where you buy a drink, put in on a tab and leave without paying. Naturally, the day will come where you will have to pay your tab because it is a debt. However, the way the situation in the Eurozone is developing, it looks more like these tabs will either increase or should the Euro collapse, these debts will never be paid. Data released on Monday shows that the situation has still not changed. Germany currently is the biggest creditor to the southern European states and is owed around € 500 billion. The graph shows that countries like Spain, Italy and Greece, whose economies are all in rough condition, are the biggest debtors. It is widely accepted with the world of economic sciences that Germany, the Netherlands, Finland and Luxembourg will never get their money back.

World Bank projects Russian recovery in 2016-2017

The World Bank has released a new report in which it anticipates a 1.5 percent growth of the Russian economy in 2017 and therefore and end to the contraction spiral that has gripped Russia since 2014. Latest figures showed a contraction of 3.8 percent in 2015. The bank also expects that the Russian ruble will strengthen to roughly 58.2 rubles relative to the US dollar. Furthermore, capital outflow is expected to shrink to a $67 billion. As the reasons for the turnaround the report explicitly names the Russian authorities measures, which were taken to stabilize the economy. The main focus for the Russian economy will be the strengthening of trade relations with China and the integration within the Eurasian Economic Union. Both hold significant potential for future growth and are Russia’s answer to the sanctions imposed by the West.