China has put its new global payment system in place in a move to challenge the US-dollar’s dominance. Major oil reserves were found in Israeli occupied Golan Heights and the oil price has increased as a result to the Russian military campaign against ISIS. Meanwhile Russia’s gold reserves reach an all time high after they have dropped at the beginning of 2015 when Russia liquidated reserves to prop up the ruble.

China’s Central Bank has started its new global payment system, which allows for cross-border transactions in Yuan. It is called the China international Payment System (CIPS) and its intentions are to internationalize the Yuan and therefore break the US Dollar’s dominance. CIPS enables payments in cross-border trade, direct investments, financing and personal remittances. So far nineteen banks registered for the use of CIPS with eight of them being Chinese subsidiaries of foreign banks, including Citi, Deutsche Bank, HSBC and ANZ. The introduction of CIPS is in line with previous Chinese steps undertaken to reduce its reliance on the global transaction services organization SWIFT. So far the Chinese currency has surpassed the Japanese Yen but is still well behind the US Dollar, the Euro or the Pound. Meanwhile China is still awaiting the admittance of the Yuan into the IMF currency basket.

Major oil reserves found in Israeli occupied Golan Heights. Israeli drilling firm have discovered vast oil reserves in he territory bordering to Syria. Domestic exploration firms have long been complaining that Israel was surrounded by oil rich states but did not have a single drop for itself. After drilling 530 exploratory wells, Israeli drilling firm Genie finally got lucky, Genie CEO Geoff Rochwanger said to the Times of Israel. However, the Golan Heights, where the oil reserves were discovered, was initially occupied from Syria in the Six-Day war in 1967. The region is internationally recognized as Syrian territory that has been annexed and Syria is demanding Israel withdrawal of its armed forces from the district.

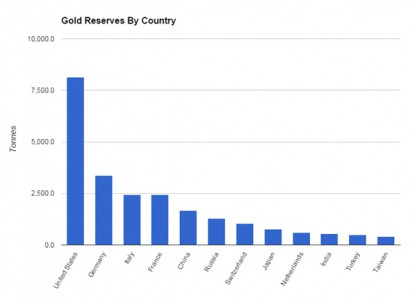

Russia’s gold reserves reach historical high. Russia’s international gold reserves have climbed to $ 371.267 billion. Russia remained among the top ten countries ranked by their gold reserves despite great losses in the previous year. International gold reserves are highly liquid foreign active that are already placed ready to trade so they can be quickly sold in the event of a financial crisis. “The larger these reserves, the more options do the Russian authorities have”, Oleg Shakhov from the Russian Academy of Entrepreneurship told Sputnik. High gold reserves stabilize the economy and make it more robust in times of nervous and volatile markets. The World Gold Council has published recent numbers about national gold reserves.

Oil prices rise amidst Russian military operations in Syria. Oil prices have risen 12 percent since the start of the Russian campaign against ISIS. The price for Brent reached $53 per barrel in Friday and therefore reached a two-month high. Oil prices have a habit of reacting to crisses in the Middle East. Even though oil production is not directly affected by the fighting, crude prices rise over fears by market participators that the conflict could spread to the large oil producing countries. “Syria is not a crude oil producer—its real significance to the energy markets is not a heightening of its ongoing internal conflict but rather the risk of contagion within the region at large,” the Wall Street Journal quotes NUS Consulting Group as saying.

Especially the effects on the oil price by Russia’s military campaign and the newly discovered reserves on the Golan Heights should be closely watched in the near future. Oil prices are closely linked to the price for natural gas. An increase would greatly benefit the Russian economy and the ruble. Should the effects continue then Russia is not likely to stop its military campaign any time soon as the rising prices would be a pleasant side effect. Meanwhile the Israeli exploration team will surely think twice before extracting the newly discovered oil. It should be common sense that the extraction of oil from illegally annexed Syrian territory equals theft and would draw international condemnation towards the country.