The last week has shown how the world of economics is often directly being influenced by geopolitics. ISIS has significantly decreased Iraq’s oil output and therefore benefited Saudi Arabias export policy. The IMF is breaking with its on rules to finance Ukraine, revealing the pro-American character of its actions. Meanwhile Germany and China open the first renminbi nominated stock exchange outside of China marking a milestone in their cooperation.

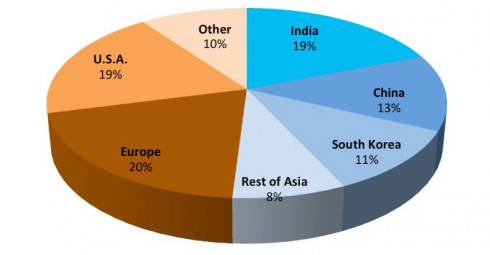

Iraqi oil production under attack by ISIS. Since the terrorist militia crossed over to Iraq from Syria it has systematically occupied Iraqi oil production sites. According to the Iraq Oil Ministry spokesman Assem Jihad this has resulted in Iraq losing 400,000 barrels of daily oil production. Currently the loss amasses to more than 10% of the daily Iraqi production but would be even higher if Iraq hadn’t increased its production in the South of the country in order to compensate for the losses. According to the spokesperson ISIS did not conquer the oil fields to finance its operations. They lack the required technical expertise to develop oilfields like in the Nineveh Governorate. He added that ISIS does not only rely on oil to finance its operations but has alternatives streams of income. According to the US Pentagon, the terrorist group depends a lot on donations. It remains questionable why ISIS would explicitly waste resources on the occupation of oil fields, which it has no gain from. Maybe the explanation lies in Saudi Arabia’s recent endeavor of trying to acquire market shares in Europe from other oil producers. Recently Saudi Arabia lowered its prices in order to push Russia from the Polish market. Looking at Iraq’s high share of exports to Europe, it could be that Saudi Arabia is pursuing similar goals.

IMF to change its lending rules to outmaneuver Russia in Ukraine. The International Monetary Fund is eying potential changes to its lending policy in order to further finance Ukraine. Kiev is currently demanding that Russia would accept a 20% haircut on a loan worth $3 billion, which was granted to Ukraine in an agreement between Vladimir Putin and former president of Ukraine Viktor Janukovitch. Kiev argues that the loan is of a private nature and that other private lenders have accepted such a haircut, therefore Russia should, too. Russia is convinced that the loan is an official public loan granted from one state to another and therefore the agreements reached between Kiev and its private lenders should not apply. Should the two countries not reach an agreement then Kiev would be classified as having defaulted on part of its debt to another state. According to IMF rules it would no longer be eligible to receiving credit from the IMF. In this case Kiev would completely run out of money and slide into total bankruptcy, likely resulting in a revolt against the Poroshenko government. In order to avoid such a scenario the US dominated IMF is set to change its policies. Doing so would be crossing a line. It would demonstrate to the world that the IMF is in fact part of America’s political arm. Since the IMF is financed by tax money of the international community, lawmakers would think twice if they put their money into the IMF or in some newly created alternatives like the Asian Infrastructure Investment Bank.

China and Germany set up yuan-denominated exchange. Germany’s stock market administration Deutsche Börse Group has joined forces with the Shanghai Stock Exchange (SSE) and the China Financial Futures Exchange (CFFEX) in order to establish a market for yuan-denominated investment products outside of China. The project will start under the name of CEINEX in November and will be headquartered in Frankfurt. CEINEX will start with offering Exchange Traded Funds (ETF) and bonds.

“CEINEX is a milestone in the strategic cooperation amongst our three exchanges. Its value proposition to ‘trade China in international markets’ is a major step forward in the internationalization of the RMB [renminbi or yuan – Ed.]. It provides a sound basis for the development of a successful capital market between Europe and China. We are happy to contribute to this excellent development,” Carsten Kengeter, CEO of Deutsche Borse is quoted by RT.

Deutsche Börse and the China Foreign Exchange Trade System also signed a strategic cooperation agreement earlier on Thursday, to connect markets and foster product innovation. China and Russia have long been advocating a stronger cooperation with Germany while the US is trying to put the brakes on nearly every project between the three countries. Meanwhile the leadership of the EU is also trying to influence its members in order to control who they do business with. Switzerland has made a free trade agreement with China back in 2013 because it is not an EU member and therefore free in making decisions. No other EU member has yet made such a trade agreement with China which shows how the US friendly policies of the EU hamper the economic development of its members.