Illustrative Image

DEAR FRIENDS. IF YOU LIKE THIS TYPE OF CONTENT, SUPPORT SOUTHFRONT WORK :

BITCOIN: bc1qv7k70u2zynvem59u88ctdlaw7hc735d8xep9rq

BITCOIN CASH: qzjv8hrdvz6edu4gkzpnd4w6jc7zf296g5e9kkq4lx

PAYPAL, WESTERN UNION etc: write to info@southfront.org , southfront@list.ru

The energy crisis may become the next blow on China, as Beijing is already facing a significant shock in the sphere of energy supply. A blow in such a fragile area could cause serious damage to Asia’s largest economy, after the Evergrande crisis caused significant turmoil in the country’s financial system.

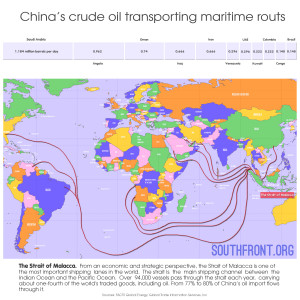

The energy security remains an Achilles heel of the Asian market. Since China does not have enough of its own resources, pipeline supplies are not sufficient and have to be assured by long-term bilateral contracts, today the main way of energy supply to the country is by sea.

Click to see full-size image

China is trying to diversify the options, including Beijing’s attempts to increase its gas supplies from Russia and Turkmenistan. However, the threat over the Central Asian region has significantly grown, following the destabilization of the situation in Afghanistan.

The forced restriction of electricity consumption in China is a result of the consistently growing domestic demand for electricity and the sharp rise in coal and gas prices, as well as the global goal to reduce CO2 emissions, which Beijing is committed to.

China’s stability has been provided by the coal-fired energy production that consisted about 70% of the country’s energy balance. That’s why another threat for the country is the global decarbonization initiative.

Click to see full-size image

China’s energy coal futures rose sharply last month and are still breaking records as concerns about mine safety and environmental pollution constrain domestic production.

The Chinese issues of electricity shortage reflect the global trend of serious shortage of world energy supply. The current crisis broke out about 2-3 weeks ago and was boosted by a variety of factors.

The first victim of this crisis were European markets.

Bloomberg reported that the average price of coal for delivery in the EU in 2022 had increased to $137 per ton, reaching the highest value in the last 13 years. This was caused by the increased demand for this type of fuel amid the rising of gas prices. At the same time, the coal reserves in European countries are quite small, and supplies from Russia are not enough, while the supplies from Australia, South Africa and Colombia are complicated by the long logistic.

Click to see full-size image

In addition, such a large exporter of electricity as Germany is expected to stop its nuclear power plants just at the end of the year. They will stop supplying electricity to the European networks that have so far carried a significant load. The resulting gap will influence the whole Europe.

The head of Chevron, Michael Wirth, said that he predicts high prices for gas, LNG and oil in the foreseeable future, as large oil and gas companies are reluctant to invest in new projects, which may lead to a shortage of supply. One of the reasons is the desire of shareholders to get an immediate effect from investments instead of reinvesting in new developments.

Click to see full-size image

The natural gas market has faced a fatal combination of circumstances that gathered at the very moment: a reduction in fuel reserves in Europe following a long winter season, unstable supplies from Russia and an increase in demand for LNG in Asia, which prevented the restoration of reserves in the summer, not mentioning a decline in production in the North Sea due to maintenance postponed earlier because of the pandemic and the current environmental conditions, including the Hurricane Ida that was the main trigger to the crisis’ rapid aggravation.

The background reasons of this situation should be traced in the COVID global hysteria, which disrupted the course of usual global economic processes. Further manipulations of this topic led to the lack of forecasts of the necessary accuracy about the recovery of the world economy. This hit a shocking blow to the energy sector.

The first victim was Europe. The U.S. is frantically securing itself, while China found its economy on the brink of the most complicated challenges in its modern history.

Today, there are no foreseeable ways to quickly fix the problem, as winter is coming.

It is this global instability that is leading towards world war, a direct Sino-American confrontation one scenario. one way or another this confrontation is coming, dragging us all towards the Apocalypse.

https://www.ghostsofhistory.wordpress.com/

Slightly over dramatic. The Chinese can secure additional energy supplies through their allies, Russia, Iran etc.

Yes its especially good news for Iran.

China cant breach the International Rules Based Usury Order. Both Iran and Russia are sanctioned.

If China buy crude oil from Iran, we can sue them in Court and they must pay America $1 trillion, and if China dont pay we can freeze all China’s assets in America………………………………LOL.