DEAR FRIENDS. IF YOU LIKE THIS TYPE OF CONTENT, SUPPORT SOUTHFRONT WORK:

PayPal: southfront@internet.ru

Donation alerts: https://donationalerts.com/r/southfront

Gumroad: https://gumroad.com/southfront

Or via: http://southfront.org/donate/ or via: https://www.patreon.com/southfront,

BTC: 3Gbs4rjcVUtQd8p3CiFUCxPLZwRqurezRZ,

BCH ABC: qpf2cphc5dkuclkqur7lhj2yuqq9pk3hmukle77vhq,

ETH: 0x9f4cda013e354b8fc285bf4b9a60460cee7f7ea9

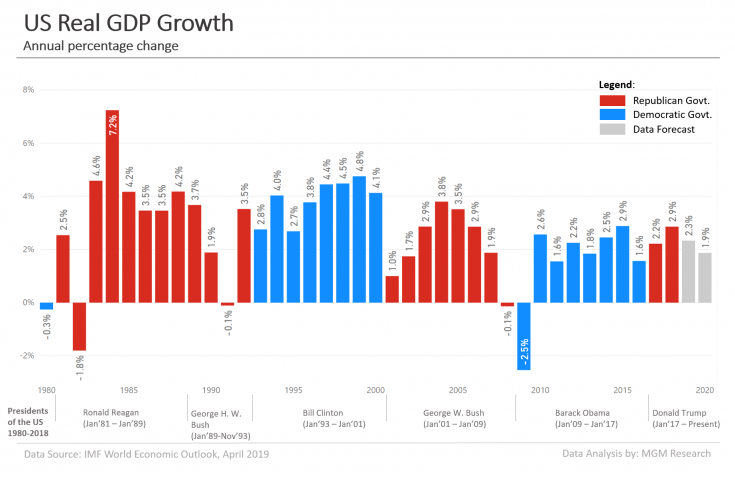

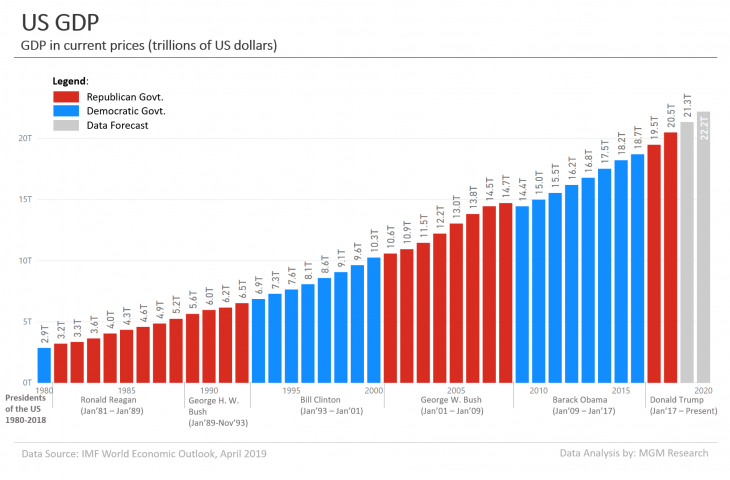

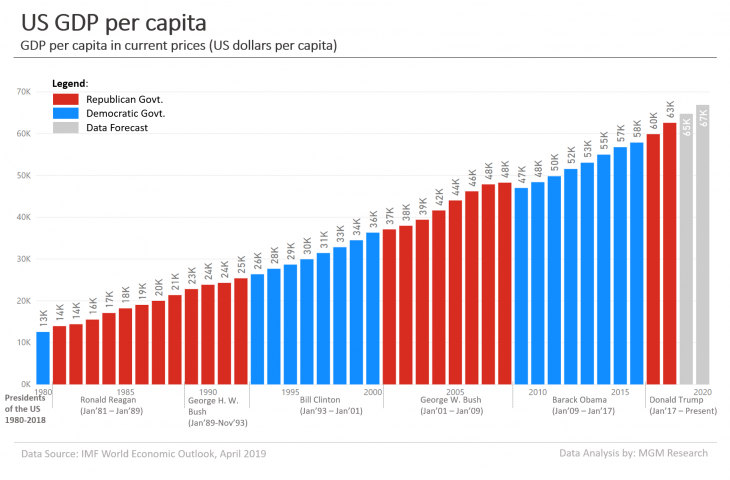

As the US struggles to salvage the economy, solve the most urgent needs of its citizens and regain a semblance of coherence and stability in the political, social and economic spheres, South Front takes a step back to evaluate the economic fundamentals of the Trump presidency. How has the US economy fared over the last four years, do the economic data indicate that the president has been successful in achieving his proclaimed objectives of ‘putting America first’ and ‘making America great again’, rebuilding the national economy and prioritizing the economic needs of those left behind by globalization, or at least was doing so before the COVID-19 pandemic wrought havoc on the country’s economy?

It is universally recognized that the US is going through a severe crisis, probably the most severe in its entire history, in almost all possible dimensions – political, social, economic, cultural, health. Nonetheless, the dimensions of the respective developing crises remained largely concealed until the gravity of the situation was fully revealed by the onset of the COVID-19 pandemic earlier this year.

As of late 2019 and into early 2020 the economic data was for the most part solid if not outstanding: economic growth and employment data improved considerably in 2018, particularly in the manufacturing sector, before levelling off in 2019, and were generally as good as if not better than those of the Obama presidency in most respects. The stock market was maintaining its record high levels, and according to official estimates unemployment was at a record low of around 3.7%.

Median household income was slowly if steadily increasing, and median house prices were also increasing. Another positive indicator was a substantial fall in the number of people receiving food stamps:

About 1 out of 7 Americans received food stamps (the Supplemental Nutrition Assistance Program) in 2013 in the aftermath of the Great Recession, as people struggled to find good-paying jobs again. The numbers came down slightly under Obama, and the decline has accelerated under Trump as more Americans have obtained jobs and the requirements to remain on food stamps have tightened. LINK

The Trump Administration’s Economic Plan and Objectives

Trump advocated a parochial business-magnate form of populist economic nationalism during the presidential campaign, promising to reduce the trade deficit and reinvigorate US industry, economic growth and employment. This gained him a lot of support given the extent to which companies have ‘offshored’ industrial production since the 1980s. The economic development strategy consisted of several complementary elements, including renegotiating existing trade agreements, imposing tariffs on imports of certain products and adopting other protectionist measures, reducing taxes, an extensive program of deregulation, and a massive infrastructure development spending program.

By far the most controversial element has been the imposition of tariffs on certain imports, as they have often been framed as a form of economic blackmail to demand concessions from other countries, provoking a major trade war with China and antagonizing other major trade partners.

During Trump’s presidential campaign in 2016 and since, Trump insisted that the US is being taken advantage of by its trading partners, especially though not exclusively the European Union and China.

The United States lost 34% of its manufacturing jobs between 1998 and 2010. Many were outsourced by US companies to other countries to increase profits. Others were eliminated by new technology. In 2018, manufacturers in the United States account for about 11.4% of the total output in the economy and employed approximately 8.5% of the workforce. Total output from manufacturing was $2,334 billion in 2018, and there were an average of 12.8 million manufacturing employees. LINK

The biggest segments within the sector are: Chemicals (12% of total production); food, drink and tobacco (11%); machinery (6%); fabricated metal products (6%); computer and electronic products (6%); and motor vehicles and parts (6%).

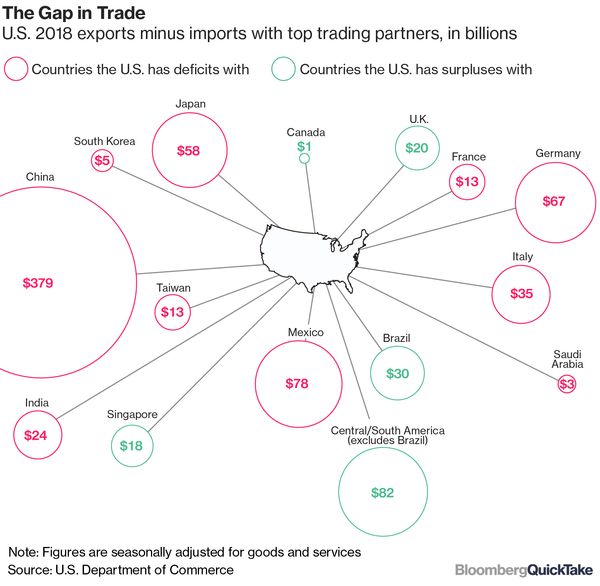

According to the United States Census Bureau, in 2017 total US exports of goods amounted to a bit over $1.54 trillion; foreign goods imported into the United States totalled $2.34 trillion, resulting in a trade deficit of about $796 billion. With China, in particular, US exported goods totalled slightly less than $130 billion, while imports of goods from China came to around $505 billion, for a trade deficit of over $375 billion with China.

In 2017, the U.S. had a balance of trade deficit with Japan. US exports of goods to Japan were almost $68 billion; but the US imported and purchased over $136 billion of Japanese goods, resulting in a trade deficit of nearly $69 billion. LINK

An underlying assumption of the Trump administration’s trade policy has been that other countries need the US market so much more than the US needs them that they will give in to US demands to renegotiate existing trade agreements to favour US interests rather than risk the consequences of being denied access to the US market or ending up in a ‘trade war’. However, as discussed below, it appears that Trump’s brash approach to negotiations and constant attempts to cower and intimidate other countries into submission is instead bringing them together in multilateral trade agreements that will ultimately exclude the US and shift the balance of negotiating power away from the US. LINK

Trump argued that one element of his trade strategy and industrial policy would be to punish companies that have outsourced production to offshore locations and bring back jobs that have gone to Asia and Mexico. While a significant number of companies have relocated production to the US as a result of the measures, many remain reluctant to do so. Moreover, US industry has not always been able to take advantage of the protective measures to increase production in the US, resulting in shortages in the supply of key inputs or the shifting of production from China to other countries not subject to tariffs. LINK

The trade war with China

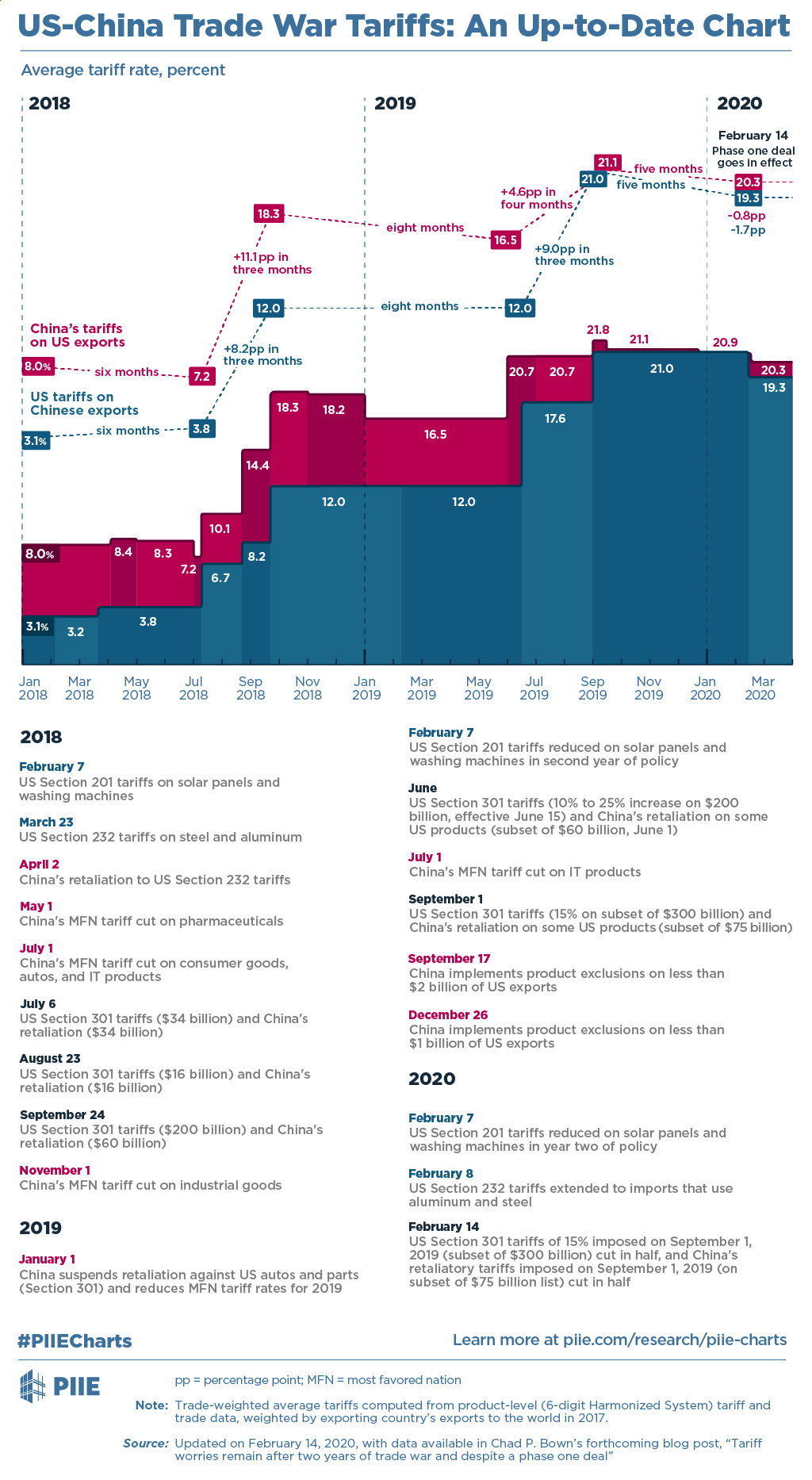

What started in 2018 with US levies on imported washing machines and solar panels to protect and stimulate domestic production escalated into a cycle of tariffs, talks, threats and temporary agreements. Beyond the disputes between the US and China over tariff levels and targeted product lists are broader and more formidable issues such as market access, intellectual property, national security, the proper role of government in the economy and competition for dominance in emerging technologies and market sectors.

Trump says China and other trading partners have long taken advantage of the US, an argument that enjoys broad support in the US. He points to the trade deficit (the difference between imports and exports) as evidence of a hollowing out of US manufacturing and the loss of US industrial power and prestige. Over more than year, he ratcheted up tariffs on specific products, which are a tax on imports, while encouraging US companies to move production back to the US.

Overall, the trade war with China has proceeded in five stages since early 2018. The first six months of 2018 featured only a moderate increase in tariffs. The months of July through September 2018 resulted in a sharp tariff increase on both sides: US average tariffs increased from 3.8% to 12.0%, and China’s average tariffs increased from 7.2% to 18.3%. In stage three, there was an 8-month period (September 25, 2018, through June 2019) of little change in tariffs. From June to September 2019, another set of tariff increases kicked in. In the current stage five, and despite the phase one agreement, tariffs between the two countries remain elevated and may remain so for a long time. LINK

While China, which accounts for the bulk of the deficit, has been the main target, Trump also pulled the US out of a proposed trade deal with Japan and 10 other Asia-Pacific countries, calling it unfair for US workers, and started talking directly with Japan instead. He has threatened 25% tariffs on millions of imported cars and car parts from Europe and Japan, and also threatened to impose tariffs as retaliation against France for its new digital tax on technology companies.

The Trump administration first targeted steel and aluminium imports from several countries on national security grounds, arguing that a weakened US industry would be less able to build weapons in an emergency. In January 2018, the US imposed tariffs and quotas on imported solar panels and washing machines. On March 1, 2018, he announced a 25% tariff on steel imports and a 10% tariff on aluminium.

On April 3, 2018, Trump announced 25% tariffs would be imposed on $50 billion in Chinese imported electronics, aerospace, and machinery. The administration also demanded that China to stop requiring US companies to transfer proprietary technology to Chinese firms in order to invest in China and gain access to their market, and that China stop subsidizing the 10 industries prioritized in its “Made in China 2025” plan. China retaliated immediately, announcing 25% tariffs on $50 billion worth of US exports to China. LINK

Before that year ended a truce was called and a deal seemed to be in the offing. But in May 2019, Trump started raising tariffs on a scale not seen in decades, provoking further retaliation. Trump and Chinese President Xi Jinping agreed to restart talks.

Then Trump, claiming China had failed to keep a promise to buy more from US farmers, threatened a 10% tariff on all remaining imports from China, including clothes, shoes and electronics. Some took effect on September 2019. Others were to be introduced in December, but they were headed off by a partial deal that was also to roll back some other US tariffs. Trump has said he wants to keep tariffs in place until he’s sure China is complying with any deal — which means they could remain in place for years.

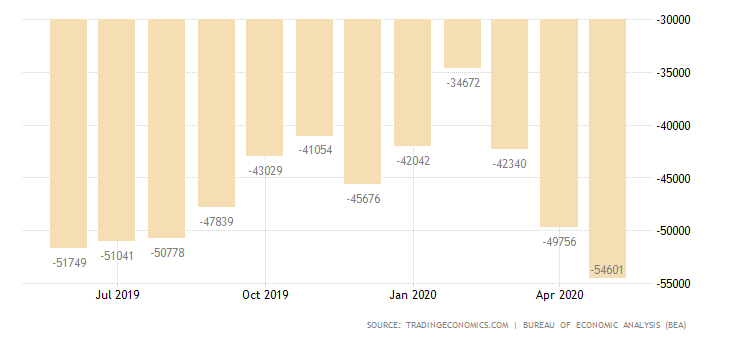

At first the results suggested the strategy had been successful. In 2018 manufacturing employment as a percentage of the total workforce rose for the first time since 1984 (albeit remaining at around 8.5%, the lowest it has been basically since the early years of the industrial revolution, rising to a peak of around 38% of the workforce in the 1940s). In 2018 there were 264,000 new manufacturing jobs created, representing the highest number of new industrial workers since 1988. However, although imports fell dramatically in 2019 and the trade deficit also fell considerably, the US also suffered many negative effects as US farmers in particular lost markets and income as China and other trading partners raised tariffs in retaliation.

Moreover, employment in the manufacturing sector levelled off in 2019, with many economic experts venturing the opinion that the beneficial impact of the abrupt shift in economic policy had probably been exhausted (including the economic boost from the tax cuts and deregulation) and that many companies were becoming much more concerned about the possible detrimental impact of a trade war with China and possibly other major trade partners. The gains made were effectively wiped out when manufacturing production and employment fell sharply in April of this year (by more than 10%) as the full impact of the lockdown measures hit, before recovering slightly in May and June.

A UN report found that exports of Chinese goods hit by the tariffs dropped 25% in the first half of 2019, for a loss to China of $35 billion. That’s consistent with an earlier analysis by Bloomberg Economics that showed US imports of Chinese goods hit by tariffs in 2018 were down 26% year-on-year in the first quarter of 2019. However, in the same period, Taiwan and South Korea saw sales of electronics components accelerate, and Vietnam saw the same with furniture – a sign that tariffs have accelerated the shift of low-end manufacturing out of China to other low-wage countries rather than to the US. Giant Manufacturing Co., the world’s biggest bicycle maker, started moving production of US-bound orders out of its China facilities to its home base in Taiwan as soon as it heard Trump threaten tariff action in September. LINK

Trade relations with other countries

In January of 2017 Trump signed an order to withdraw from further negotiations on the Trans-Pacific Partnership, Trump pulled out of the Trans-Pacific Partnership, arguing it would force US workers to compete with lower-paid workers. The objective was to replace it with a series of bilateral agreements. However, as a result, Japan and the European Union announced a separate trade deal in July of the same year, agreeing to increase Japanese auto exports to the EU and European food exports to Japan.

In August 2017 the Trump administration began renegotiating the North American Free Trade Agreement with Mexico and Canada. Trump had threatened to withdraw from NAFTA and hit Mexican imports with a 35% tariff. The new treaty, called the US-Mexico-Canada Agreement (USMCA), was ratified by all three parties in early 2020.

It appears however that the Trump administration’s aggressive and abrasive approach to international trade and investment negotiations may have backfired in Asia and Europe. Although generally compliant with many of the US’ foreign policy demands, however reluctantly, both the EU and Japan and South Korea have attempted to avoid becoming embroiled in the US trade war with China and are attempting to maintain economic relations with the Asian giant.

Most recently, Japan and South Korea have announced their intention to establish a multilateral trade agreement with the ASEAN countries (Association of South East Asian Nations) to replace the Trans-Pacific Partnership, which will probably thwart the US’ intention to use its size to its advantage in bilateral negotiations and may exclude the US entirely if the US does not adopt a more conciliatory approach.

Though refreshingly direct and honest (exposing the US’ raw geostrategic and economic interests that remained concealed by Trump’s more diplomatically-minded predecessors), the deterioration in the US’ geostrategic relations with key allies in Europe and Asia due to Trump’s nonchalant abrogation of fundamental treaties and international obligations and extortionist negotiating style may yet have major ramifications that go well beyond the economic realm.

In Europe numerous relatively insignificant countries, apart from the importance of their geographic location (i.e., talking purely in terms of their economic and geopolitical weight) – such as Poland and the Ukraine – are eager to follow the US’ lead in confronting Russia economically and militarily, as the politicians in power in those countries score many points from Russia bashing. However, the economic and political heavyweights on the continent, particularly France and Germany and to a lesser extent Italy, appear increasingly reluctant to continue sanctioning Russia and cutting all economic and development ties, whilst simultaneously confronting and provoking Russia militarily, as they have borne the brunt of the abrupt disruption to economic relations, and they might also be among the first casualties if the incessant NATO war games and shadow play along the Russian border result in a catastrophic live-fire clash.

A similar development may be taking shape in Asia, where South Korea and Japan also appear reluctant to continue supporting the US’ reckless military and economic provocations against China given that they too will suffer the heaviest economic and military consequences of any resultant clash while the US remains far removed from the immediate impacts of its actions. This was demonstrated by two apparently unrelated events, Japan’s decision to cancel the purchase of two ‘Aegis Ashore’ anti-missile systems, and the announcement of a multilateral trade agreement being formed in the Asian region.

The Japanese purchase of the anti-missile systems would have been a huge financial windfall for its manufacturer Lockheed Martin, and moreover it would have been operated by US military personnel thereby enabling them to put US interests first in an emergency situation in the event they diverged from those of the host nation. Of these developments Salman Rafi Sheikh argues:

Whereas the deployment of the Aegis Ashore missile system as a part of its strategic deployment in the Asia-Pacific region would have boosted the US capability to monitor China and Russia, Japan’s abrupt cancellation of the deal, particularly at a time when the Chinese were already showing their grave concerns about it, does strongly show that the US influence even on its traditional allies is decreasing fast.

Nothing better illustrates the decreasing US economic influence than the recent announcement by the member countries of The Regional Comprehensive Economic Partnership (RCEP), confirming that the agreement will be signed in 2020.

RCEP … brings together the 10-member Association of Southeast Asian Nations (ASEAN), China, Japan, South Korea, Australia and New Zealand. LINK

An increasing number of articles have appeared in Japanese media outlets reconsidering the overriding strategic priority since the end of World War II of unquestioning allegiance to the US military alliance (LINK), and the wisdom of pursuing confrontation with China. (LINK1, LINK2)

National Debt and Budget Deficits

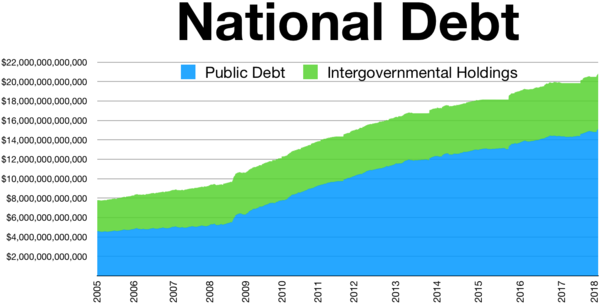

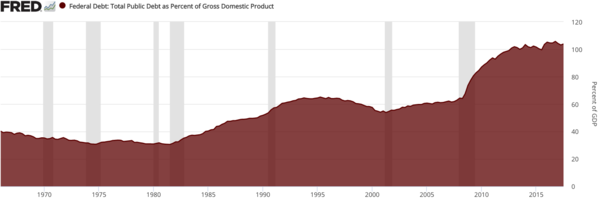

Trump promised to reduce the national debt by reducing federal spending and eliminating some federal agencies. But federal government spending has increased and the national debt has increased substantially under his administration, going from just under $20 trillion in January 2017 to more than $24 trillion by April 2020.

Trump promised to eliminate the Department of Education and the Environmental Protection Administration, but instead cut funding for the Education Department by $10.4 billion and cut the Energy Department budget by $2.2 billion, insignificant sums relative to the deficit.

Trump promised to keep existing Medicare and Social Security benefits in place. Social Security is self-funded, Medicare is only 53% self-funded. These two programs cost $1.587 trillion, or 39% of total federal spending.

Trump stated his objective of achieving economic growth of 4% annually to increase tax revenues and create jobs. Cutting taxes was a key part of the economic growth plan, on the basis that the resulting stimulus to the economy would be sufficient to offset the loss of revenue.

In January 2018, the administration released its infrastructure plan. It provided details lacking in the June 8, 2017, “Rebuild America” plan. That plan outlined $200 billion in spending over 10 years to leverage $800 billion in business spending, in order to construct or repair roads, bridges, and airports throughout the country. However. disagreements between Trump and Congress about long-term infrastructure plans and priorities have prevented progress from being made. LINK

The ‘Defense’ Sector

Trump promised to increase the Department of Defense budget. The FY 2020 budget authorized $738 billion in national security spending, far above the $606 billion in the FY 2017 budget.

In 2018, U.S. aerospace sales (NAICS 3364) were up 8.5% to a bit over $320 billion (from $295 billion in 2017), while net income set a new all-time annual high of $36.3 billion, up and impressive 64.9% from 2017 ($22 billion). In 2018, stockholders’ equity increased to $90.9 billion, up 13.3% from 2017 resulting in a higher equity ratio (equity/assets) of 19.1%. The US aerospace industry has overall been performing well for most of the Trump presidency, however it has been hit hard by the economic slump this year. Companies with a large proportion of military sales however are well placed to weather the storm as military spending continues to climb pushed ever higher by bipartisan competition to provide most support to the sector. LINK

Deregulation

During Trump’s first 100 days, he asked federal departments for a list of unnecessary or counterproductive regulations to be eliminated. The US Chamber of Commerce subsequently reported the Trump administration had issued 29 deregulatory executive actions, and federal agencies issued many more, including a Consumer Finance Protection Bureau regulation that allowed consumers to sue credit card companies. The administration also made significant efforts to revoke Clean Air Act and Clean Water Act regulations.

In 2018, President Trump signed the Economic Growth, Regulatory Relief, and Consumer Protection Act. The act eased regulations on banks with assets from $100 billion to $250 billion and weakened the Dodd-Frank Wall Street Reform and Consumer Protect Act of 2010.

On June 1, 2017, Trump announced the US withdrawal from the Paris Climate Agreement. The 195 signatories had pledged to cut their greenhouse-gas emissions to a level that’s 26% to 28% below 2005 levels by 2025.

On October 9, 2017, the Trump Administration announced it would repeal the Clean Power Plan. The repeal would withdraw Obama-era limits on carbon emissions at U.S. power plants. That was part of Trump’s campaign promise to revive the coal industry while remaining committed to clean coal technology. Trump claimed this would raise wages by $30 billion over seven years.

On September 10, 2018, the administration planned to allow oil drillers to emit more methane into the atmosphere. It also began opening up more federal land to oil drillers. LINK

Shale Sector

One of the sectors most favoured by the Trump administration’s policies of extensive deregulation and fiscal incentives was shale oil production. However, production costs are high compared to oil and gas production in many countries and the sector has been hit hard by the fall in oil prices. Any attempt to rescue the sector from widespread default and bankruptcy would be extremely costly and, unless there is a severe disruption to global supply chains in the future, it is likely that much of the investment in this sector will have to be written off. One of the pioneers and largest players in the sector (Chesapeake Energy) recently filed for bankruptcy, and many more will surely follow. LINK

Thus it appears that the decision to back the shale oil sector in particular, but also other fossil fuel sectors, at the expense of supporting ‘clean’ and renewable energy sectors, was a major and extremely costly strategic blunder. Almost all other countries remain committed to the climate change commitments, and it is most likely that the economic, technological and strategic importance of clean and renewable energy sectors will only increase over time as the importance of fossil fuel sectors declines. Failing to recognize this and pouring more money into subsidizing the fossil fuel sectors – and above all the shale oil sector – when there are so many low cost oil and gas producers with abundant supplies would just perpetuate and exacerbate the error.

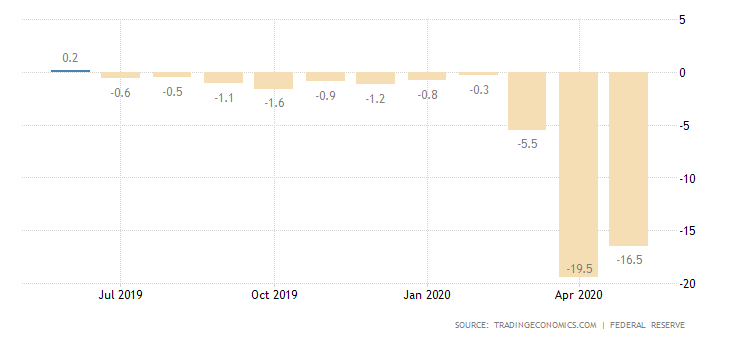

Post-virus outbreak damage control

The economic damage caused by the pandemic outbreak in the US has been staggering, as it continues to reap a huge number of victims and disrupt economic activities. Experts and pundits will no doubt be arguing for many years whether or not this is the fault of the Trump administration, an act of God, a freak of nature, or something else.

The Congressional Budget Office said in April that it expects the federal budget deficit to hit $3.7 trillion by the end of fiscal year 2020

The CBO is predicting that the national debt will eclipse the annual economic output of the United States in 2020, with the ratio of federal debt to GDP rising to 101%.

That would be the deficit’s largest size as a portion of the economy since World War II.

The CBO projected that the economy will shrink by 5.6% over the course of the year, and that the unemployment rate will rise to 16% in the third quarter and remain at a high 11.7% by the end of 2020, averaging 11.4% for the year. LINK

Mortgage defaults hit record levels in June, and the situation is not likely to improve soon. LINK

On 9 July Reuter reported that as the number of new coronavirus cases in the United States rose to a single-day record, fresh government data showed another 1.3 million Americans filed for jobless benefits, highlighting the pandemic’s devastating impact on the economy.

Moreover, the virus is surging again as over 60,000 new COVID-19 infections were reported on Wednesday of last week (the 8th of July) and deaths in the US rose by more than 900 for the second straight day, the highest since early June.

Unemployment claims hit a historic peak of nearly 6.9 million in late March. Although they have gradually fallen, claims remain roughly double their highest point during the 2007-2009 economic slump. With coronavirus cases rising in 41 of the 50 US states over the past two weeks, many states have had to suspend plans to reopen businesses and lift restrictions. LINK

Conclusion

As is usually the case, experts and commentators remain divided over the economic performance of the Trump administration, and supporters and critics can each cite relevant data and economic and financial sectors and indicators to justify their opinions.

As of late 2019 and into early 2020 the economic data was for the most part positive if not as outstanding as Trump predicted during the presidential campaign: economic growth and employment data improved considerably in 2018, particularly in the manufacturing sector, before levelling off in 2019, and were generally as good as if not better than those of the Obama presidency in most respects. The stock market was maintained its record high levels even if the rate of growth stalled, and according to official estimates unemployment was at a record low of around 3.7% by late 2019 (critics noting that the official statistics in the latter respect in particular were dubious). Median household income was slowly if steadily increasing, and median house prices were also increasing.

However, although the Trump administration’s trade policies, sweeping deregulation and tax cuts were followed by improved trade balance and manufacturing production results in 2018, the improvements levelled off in 2019 suggesting that the gains were limited.

The utter devastation wrought by the COVID-19 pandemic in the US, by far the country most affected in the world, threw all the previous results and calculations into turmoil. Even a preliminary assessment of the Trump administration’s performance in this respect is beyond the scope of this essay, other than to note that the administration, and the US as a whole, were clearly extremely unprepared for the catastrophe. Two of the most concerning developments in this regard were the inability to provide adequate protective equipment for medical personnel on the front line in the fight against the virus, and the failure to implement measures to guarantee continued essential production resulting in huge waste of food production in particular even as millions were passing through serious food shortages. LINK1, LINK2, LINK3

At the same time, it should be noted that most of the difficulties faced by the Trump administration and the US in general amid the coronavirus crisis were a result of the internal political struggle and even sabotage by political opponents of President Trump. In these complicated conditions, the US is yet to even begin the long and arduous process of damage control, stabilization and regaining lost ground. Whether and how efficiently and effectively this can be done will be the ultimate litmus test for the Trump administration and US society as a whole.

MORE ON THE TOPIC:

U.S. GDP means nothing since 2008 and the introduction of QE Unlimited, FED is dumping free money into Fortune 500, companies, wall street and banksters which they will never repay.

Sofar $8trillion and counting.

While avg Joe gets only crumbs or nothing at all.

Its socialism for the elit.

They Inflate the price of their own stocks by buying them up via free loans than selling them back and forth creating an illusion of profit.

You really think Tesla is the same worth as VW Group or Toyota?

Look at how many cars each produce a year…

VW and Toyota around 12-13million each.

Tesla….

Or is Facebook really worth a $100billion

If you believe that I have s bridge to sell you…

The U.S. economy is dead, was killed by Nixon and every President and major company CEO since him whom outsourced production from the U.S. to China.

What Trump is doing is too little too late.

Its not the question if the U.S. will default but when.

Germany with a population of 80million exports more than the whole U.S.

Thats how weak the U.S. economy is.

The US is a world leader though in the export of Terrorism :)

Indeed.

I think that military capacity is declining and materials aging…look at all the F-16 crashes…another yesterday in New Mexico, materials getting old and obsolete.

The warmongering deadbeat beggars economy can be summed by by this clear message in the photo:

https://uploads.disquscdn.com/images/5c19a96bded58ab0eb211248d2d03f1c630ba9cf9c8aebf72dbcec6befde1025.jpg

Only thing I care about is the fact that manufacturing is less than eleven percent in gdp proportion and employment ,manufacturing has gone down 34 percent and still not back and that food stamps went down (mostly via tougher thresholds).

As far as I am concerned , we should have been shown graphs in CONSTANT dollars to see if anything changed .

I remain unconvinced Trump has helped the Average Joe in any way more than his predecessor . Lone Ranger is right, Nixon stuffed the working man and it is crap ever since.

The US is dying and probably will cave in my lifetime ; another twenty years!