On September 20th, the International Consortium of Investigative Journalists (ICIJ) published the results of its global investigation into money laundering.

“From Ukraine to the United States, from Tunisia to Turkmenistan, a global ICIJ investigation details the punishing human cost of laundered trillions,” begins the piece titled “Unchecked by global banks, dirty cash destroys dreams and lives.”

The article begins with a personal story of Emily Spell and her dead brother Joseph Williams, who had overdosed on fentanyl – “the deadliest narcotic in the world.”

“And even after they saw the autopsy report, it wasn’t until much later that they learned of the global forces responsible for Joe’s death.”

The investigation was specifically into the fentanyl network spread back to China, “relying on the easy movement of dirty money through brand-name financial institutions, to deliver lab-designed opioids to rural North Carolina and across the U.S.”

The fentanyl drug ring was (and still is) powered by more than $2 trillion which are sloshed around the globe are contained in a cache of secret financial records obtained by BuzzFeed News and shared with the International Consortium of Investigative Journalists.

The files, known as suspicious activity reports, or SARs, “provide a worldwide tour of crime, corruption and inequality, with starring roles played by politicians, oligarchs and honey-tongued swindlers, and crucial roles by the bankers who serve them all.”

Essentially, it is not that alleged or actual totalitarian regime that hurt the average person’s life around the world, but rather the massive scale in which money laundering or general financial crime, which appear to be far greater issues.

“People may not be aware of issues like money laundering and offshore companies, but they feel the effects every day because these are what make large-scale crime pay — from opioids to arms trafficking to stealing COVID-19- related unemployment benefits,” said Jodi Vittori, a corruption expert at the Carnegie Endowment for International Peace.

And where the money comes and goes behind the fentanyl network is, in fact, the most interesting piece of evidence that needs to be unearthed, since it is obvious where the drug comes from – after all it’s called “China White.”

An example is given with Brandon Hubbard, who was arrested and is serving life in prison for being part of the network.

“That’s the first thing they asked me when they came in the door,” Hubbard said in an interview from prison. “‘Where’s the money?’”

The leaked documents, known as the FinCEN Files, include more than 2,100 suspicious activity reports written by banks and other financial players and submitted to the U.S. Treasury Department’s Financial Crimes Enforcement Network.

BuzzFeed News even reported that many of the files were gathered while the investigations into alleged Russian meddling in the 2016 Presidential Elections was going on.

Evidence of a massive network was discovered that actually ruins people’s lives and the main story in MSM at that time was that Moscow was allegedly trying to get US President Donald Trump elected.

This also relates to the nature of SARS:

“SARs are not evidence of wrongdoing. They reflect views by watchdogs within banks, known as compliance officers, reporting past transactions that bore hallmarks of financial crime, or that involved clients with high-risk profiles or past run-ins with the law.”

FinCEN told BuzzFeed News and ICIJ that it does not comment on “the existence or non-existence of specific SARs.”

It released a statement about unnamed “media outlets” that said “the unauthorized disclosure of SARs is a crime that can impact the national security of the United States.”

Days before ICIJ and its partners released the FinCEN Files investigation, the agency announced it was seeking public comments on ways to improve the U.S. anti-money laundering system.

“Four hundred journalists from almost 90 countries burrowed into the leaked records, often emerging with a thin thread of just one name or one address. They spent 16 months prying additional documents from sources, reading through voluminous court and archival records, interviewing crime fighters and crime victims and reviewing data on millions of transactions that took place between 1999 and 2017.”

These journalists uncovered some interesting stories – a Rhode Island drug dealer being connected to a chemist’s lab in Wuhan, China. They discovered scandals that crippled economies China and Eastern Europe. Even tracked tomb raiders who looted ancient Buddhist artifacts that were sold to New York galleries.

The money would be moved “erratically” to be hidden.

“Often, the person tied to a suspect transaction was one step removed from the boldfaced name: a child, an associate, or, in the case of Atiku Abubakar — a former Nigerian vice president accused of diverting $125 million from an oil development fund — a wife.”

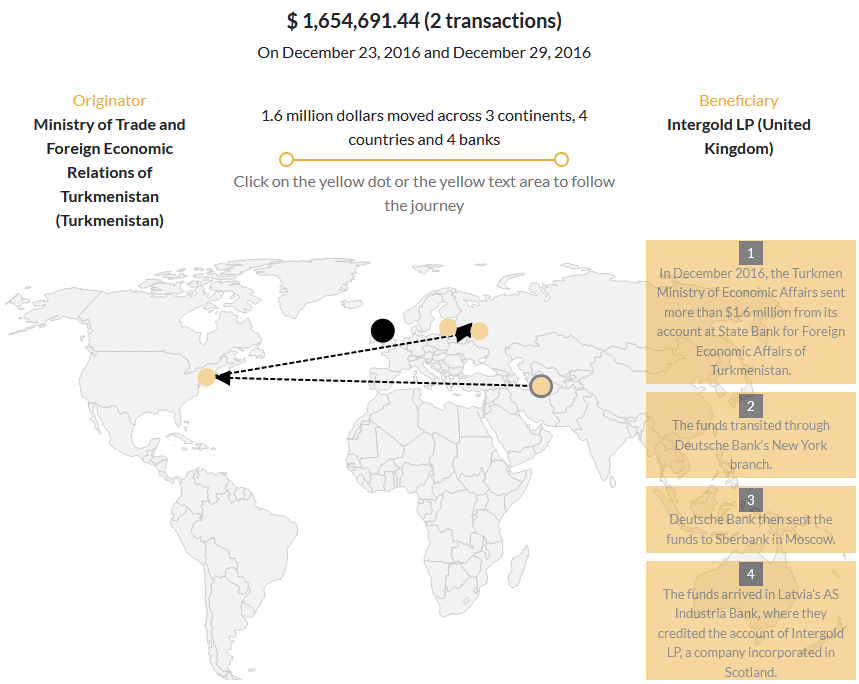

One of the most massive examples of the scheme began in Turkmenistan.

Nearly three dozen suspicious activity reports reviewed by ICIJ describe payments linked to Turkmenistan and totaling $1.4 billion between 2001 and 2016.

“Suspicious” does not necessarily mean illicit, but bank compliance officers watching the transfers determined that they deserved more scrutiny.

“The wires appear suspicious because they were often sent in a repetitive nature and typically involved suspected shell-like entities,” an employee in Bank of New York Mellon’s legal department wrote off nearly $100 million in transfers during the last three months of 2016.

In one case, Turkmenistan’s trade ministry sent $1.6 million to a company in Scotland called Intergold LP, according to leaked records.

The bank’s records indicated that the payment was for “confectionery”.

“Intergold LP was created 10 months before its transactions with the Turkmenistan government, records show. Its listed address is a store called Mail Boxes Etc. in Glasgow, Scotland. “MAKE THIS YOUR BUSINESS ADDRESS,” the storefront suggests.”

Intergold has since been renamed SL024852 LP. It’s not clear who owns the business or whether it has any legitimate purpose.

James Dickins, who signed official registration documents at the time of Intergold’s creation, also signed off on accounts for at least 200 other companies in England, according to an ICIJ analysis of companies in the FinCEN Files.

CIJ was unable to reach Dickins. Daniel O’Donoghue, who also signed Intergold’s registration application, told ICIJ that his corporate work is supervised by U.K. anti-money laundering regulators and meets the required high standards of due diligence.

“Re: Intergold LP if you have evidence of a crime you should pass it to law enforcement,” O’Donoghue said.

“This definitely sounds like a case where a shell company has been used to stash funds from state coffers,” said Annette Bohr, a research analyst at London’s Chatham House think tank who specializes in Central Asian kleptocracies. “They were likely thinking that putting down ‘confectionery’ will not ring any bells.”

Of course, questions to Turkmenistan’s trade ministry were left unanswered.

One of the other incidents that were investigated was a cave-in at a state-owned in Ukraine back in 2011, on July 29th, when 11 were killed.

This relates to Nadezhda Kulinich, one of the killed.

A tower collapsed onto the building where employees sorted coal from rock.

“Mom kept complaining that everything was falling apart,” Prykhodko told ICIJ partner Kyiv Post. Kulinich even told a visiting safety commission before the accident that “bricks kept falling on their heads,” her daughter Olha Prykhodko said.

Employees grumbled that the collapsed tower hadn’t been replaced in 50 years.

Ukrainian miners say rampant corruption puts them at risk.

Many of the country’s coal mines, including Bazhanov, where Kulinich died, are state-owned. They have long been the favorite source of plunder for kleptocrats, according to anti-corruption campaigners, employees and officials.

There are other examples of collapsed structures and people dying as a result.

The Bazhanov tower collapse, in the city of Makiivka, was one of three mine accidents in Ukraine that week that together killed at least 39 men and women.

This all takes place in the ore-rich Eastern Ukraine, where the Donetsk and Luhansk People’s Republics now exist. Wonder why they decided to split from Ukraine?

Supplying the Bazhanov mine was an obscure Cyprus company called Tornatore Holdings Ltd. Months after Kulinich’s funeral and 5,000 miles away, Peggy McGarvey, Deutsche Bank’s top Wall Street compliance officer, tried to figure out who owned Tornatore.

What caught McGarvey’s attention wasn’t the deadly accident but warning signs the bank noticed after processing two large payments on Tornatore’s behalf.

“In December 2011, Tornatore received $5.5 million from a Ukrainian mine equipment subsidiary called LLC Gazenergolizing. The next day, Tornatore sent $999,994 to a large Russian leasing company, partially owned by the Kremlin.

The high-value payments, some rounded almost to the nearest thousand or million in what experts consider a “fingerprint” of fraud, capped off a year of Deutsche Bank concerns about Tornatore. The company had made suspicious payments and had no obvious home or “line of business,” bankers wrote in reports beginning in March 2011, a few months before the accident at the Bazhanov mine that summer.”

The leasing company’s Russian bank, Globex, had assured Deutsche Bank, in response to earlier concerns, that “the client didn’t make suspicious operations.”

But McGarvey’s colleagues had persisted, asking Globex: “Please provide the business information for Tornatore.”

“No information,” the Russian bank replied.

It took Ukrainian journalists to connect Tornatore to the Makiivka accident.

In 2011, Tetiana Chernovol and Yuriy Nikolov reported that Tornatore was linked to Yuriy Ivanyushchenko, a politician close to then-President Viktor Yanukovych.

Nikolov and Chernovol, who was a member of Ukraine’s parliament from 2014 to 2019, wrote that the state-owned mine had bought replacement gear from Gazenergolizing before the collapse, but they couldn’t determine if gear had been delivered or even if the order was legitimate.

Ukraine’s state auditing agency published a report in 2011 that established a very questionable picture of the mine’s operations.

It found $21 million worth of damaged equipment at the Bazhanov mine’s headquarters, miles from the accident, and identified $205 million in “shortcomings in accounting, gross violations of financial and budgetary discipline.”

Ivanyushchenko fled after Ukraine’s 2014 revolution and is under investigation by authorities in Ukraine and Switzerland for allegedly embezzling millions of dollars earmarked for energy projects.

Essentially, the network is massive, with tens of thousands of victims, be it from fentanyl, corruption, or other issues.

And it is true that money has no smell, and that is very apparent in Germany, Russia, France, the United States and everywhere else, it appears to be ruining many more lives at a global scale than the presumed dictatorships in Venezuela, Belarus or other countries.

MORE ON THE TOPIC:

Who is Behind ‘The International Consortium of Investigative Journalists’ (ICIJ)?https://www.globalresearch.ca/the-panama-papers-and-regime-change-who-is-behind-the-international-consortium-of-investigative-journalists-icij/5519178

Fake trillions are for scammers,no such thing in the real world of economics,these vile are wannabe scabs,with no solutions towards productivety as it shows nowadays in their bogus western concepts,

in the end gold is the future,so to hell with their ran’ts,they are only parasites pretending to be rich(period)