Originally published on ZeroHedge

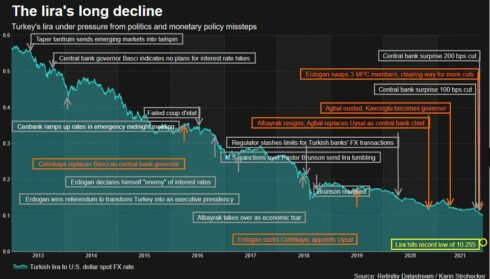

The Turkish lira cemented its status as the worst performing major of the year, plummeting to new record lows on Wednesday a day before the central bank is expected to slash rates further despite soaring inflation after Turkish President Tayyip Erdogan said he will continue his battle against interest rates “to the end.”

In comments that chopped the currency’s value by as much as 3%, pushing the USDTRY to a fresh record of 10.6364, Erdogan said he would lift the interest rate burden from people – i.e., he would force the “independent” central bank to keep cutting rates or else he will just fire the country’s top banker again and replace him with an even more docile puppet – and urged businesses to invest, hire and raise exports.

Foreign investors, having given Turkey the benefit of the doubt for much of the past decade, are finally fleeing the country, saying that Erdogan – who has long described himself as an enemy of interest rates – has swayed monetary policy too far with his frequent calls for stimulus and his rapid overhaul of the central bank’s leadership.

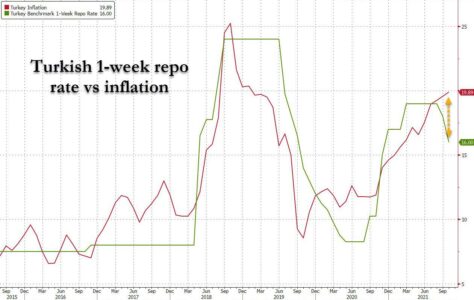

A day before a central bank policy meeting, at which it is expected to cut rates by another 100bps, the president repeated his unorthodox view that higher rates were the cause of inflation and questioned why some of our “friends” defended tight policy.

“We will lift this scourge of interest rates from people’s backs. We certainly cannot allow our people to be crushed by interest rates,” he told lawmakers from his ruling conservative AK Party in parliament.

“I cannot and will not stand on this path with those who defend interest rates,” Erdogan said, in the process sending the lira crashing to a new all-time low of 10.63, adding to steep losses after what analysts have called premature and risky monetary easing. The currency later rebounded a bit but is down 30% so far this year.

The central bank has bucked expectations and cut its policy rate by 300 basis points since September, even as inflation climbed to near 20%, delivering the stimulus long sought by Erdogan.

Taking a page out of the Fed and BOE book, the Turkish central bank has stubbornly claimed that price pressures are temporary; it is expected to cut rates by another 100 basis points to 15% on Thursday, despite inflation topping 20%.

Erdogan’s latest outburst is hardly new: in the past he has aggressively commented on monetary policy ahead of central bank meetings, often moving markets. The lira has lost 64% of its value since the end of 2017 in part due to tattered central bank credibility. As he left parliament in Ankara, Erdogan said the central bank would decide on rates “independently” when its monetary policy committee meets at 1100 GMT on Thursday.

In Touch Capital Markets senior FX analyst Piotr Matys said cutting rates on Thursday would be too risky with the lira under pressure, and he predicted no policy change, although he will most likely be wrong.

“In order to stabilize the lira, the bank would have to reverse those 300-basis-point cuts since September but I think that the bar for it to make a U-turn is still set fairly high,” he said, operating under the assumption that Erdogan cares about lira stability when clearly that is no longer the case.

“Tomorrow’s meeting could prove the most important for (Central Bank Governor Sahap) Kavcioglu. Allowing the lira to fall at such a rapid pace will cause serious damage to the Turkish economy,” Matys added. Ironically, that may be just what Erdogan wants.

The lira’s depreciation stokes prices via Turkey’s heavy imports, and also raises default risks for companies with foreign currency debt. The depreciation combined with inflation has meanwhile eaten into Turks’ earnings.

Erdogan, who appointed Kavcioglu in March, also pulled his best Federal Reserve impression and questioned why business people did not take out loans and invest in risk assets as rates were lowered in the last few months.

“Then they get together (and) talk about high interest rates,” he said, referring to the main business group TUSIAD and others.

“What type of people are you? If you are a businessman you are on the side of investment, so here are you go: loans with low interest,” Erdogan said, adding he expected them to raise investment, employment, exports and production.

Nice for Erdogan to do this financial experiment. lol How would foreign denominated loans perform? Are Turkey’s multinational corporations or bayraktar exports able to provide the reserves? Seems moslem countries will be more resilient as interests are forbidden by default.

The growth was succesfull until he made more and more non friends and enemies, which all was investors. They now only keep whats already is there.

Furthermore they spend to much money too many places in war.

I have no solutions Erdogan would love.

I have solution to jens stupidity—lobotomy

h

Against the backdrop of this seemingly unwise policy of Erdogan, the Turkish economy is expanding rapidly (22% this year) and expected to continue along this trend. I support the elimination of interest rates because they are actually a burden that the Western money-lenders put on the back of Muslim citizens of Turkey and other countries. There’s a much better Islamic model than interest-based loans for businesses, and Erdogan is moving Turkey towards that direction. Instead of interests, money-lenders ought to make partnerships with business owners. Whichever angle you look at it, interest rates are a part of manufacturing cost, and the higher the manufacturing cost, the higher prices would go.

While a “temporarily” weaker Lira has the disadvantage of making it more expensive for businesses to pay foreign debts (Debts can be defaulted on until a later date when the Lira strengthens, and it WILL strengthen), and also make it more expensive for Turks to buy foreign goods, it offers the following “immediate” advantages:

1). Increased EXPORTS due to better competitive advantage Turkish manufacturers will have against their European and Asian counterparts. This explains the rapid expansion of the Turkish economy despite a weakening Lira.

2). More job creation (employment) due to the rapidly expanding economy as manufacturers hire more people to produce more goods and services

3). Decrease in IMPORTS due to expensive foreign goods. Turks will turn to local alternatives instead.

4). Increased foreign investment. Yes, that’s correct. Business will move some branches to Turkey and manufacture locally to protect their market share from emerging local competitors. Also, investors will keep pouring in due to the favorable export conditions and low manufacturing costs.

5). Stimulation of domestic innovation and production. As foreign goods become too expensive for Turks, local alternatives will look to fill those gaps, and that spurs innovation.

In light of this development, Erdogan has been busy making deals with foreign governments to increase Turkey’s exports, especially in Africa and Asia.

Turkey’s economy is poised to expand like never before within the next five years despite all the currency wars America is waging. Erdogan and his economic policy team know exactly what they are aiming for with these continuous interest rate cuts. The Western imperialists don’t like it because this will be a successful example that other nations can emulate to the detriment of the West. America and its cronies thrive on “exploitation”, and interest-based loans are the biggest tools of exploitation.

Read this book by a repented American CIA agent: “Confession of an Economic Hitman”

The profile picture here is enforced by SouthFront. That’s not me.

You have no idea about how Turkish economy is.

You not even are able to see that Turkey cant grow canons for firtinas in the backyard with computerstuff to the drones.

You have no idea abot the Western Economics works even it does and are doing well compared to, what You prefare.

Kapitalisme is based on loans and debts. As long as they pays off and the extra production makes a living as well as its paid back by interests its a very good idea.

I dont need to read books. The main problems for Turkey are made by Erdogan and AKP being less and less related to the rest of us.

night porter knows cheese economics—demented idiot

“You have no idea about how Turkish economy is…” Are you really that much illiterate? You have no idea how things are going on in Danemark (soon to become Germany) let alone Turkish gypsies shit.

per OEcd toork economy increase 5.7% 2021, anticipated 3.4% 2022

The Turkish economy is expanding rapidly (22% this year) No!

If inflation is 20% and the economy expands by 22% this means a 22% – 20% = 2% expansion.

Most likely the inflation rate is understated probably 30% so this means an 8% contraction in the economy.

1. Increased exports. Well foreigners will get more of Turkey’s resources and products for a lower price. Wouldnt that also be harmful for Turkey’s reserves?

2. More job creation. Only for export industries and collateral jobs to it. Other sectors will suffer depending on how much they have to pay back or buy more in foreign cash or products.

3. Correct but sometimes there are foreign products that are vital, everyone still has to import it. The Turkish economy will have to produce more just for oil.

4. No. Not with these conditions of economic instability and certainly with Erdogan’s political adventures. Rates offered are low! Wouldnt your big businesses actually be incentivized to invest abroad leading to the opposite effect?

5. If it were easy to imitate, Turkey would have done it before. But yes, businesses will have to find alternatives or their costs will be higher resulting in less profits.

6. inflation as imports like oil get expensive.

In summary, Turkey is relying to become an export oriented economy but that may also backfire as your exports have an import component. Not unless exports like Bayraktar becomes 100% indigenous. Companies with foreign denominated loans will have to work harder to pay back its loans. Why would countries shift to export oriented economies and not focus on domestic consumption or investment? Does the increase in population necessitate an open system for infusions? Keep in mind that abrupt currency depreciation does not only occur once. It can happen numerous times depending on how much foreign investment Turkey begs to save their economy now. Foreign investment on the other hand wont be likely if capital controls are stiff and rates are low. When US raises its rates, all countries with foreign investments get charged higher too. lol Sorry if im all over the place, my economic skills have not been maintained and the fact that there is a big gap between textbook economics and real world economics. There’s just too much bs out there as everyone is vested.

Oh boy … and all that just as they brought all their new shiny toys into Syria to play with the big boys. What a shame. As I said here before, Turkey has no business to be in Syria. They may act tough, but it’s all big show to distract from the fact that they have a broken economy and a currency in free fall. But as we all know, politicians don’t bother with that as they all have filled their pockets already.

There may be smart people in Turkey but not in the ranks of politicians.

Any country can hurt Turkey easily now. They just have to announce sanctions against Turkish economy and this will plunge their worthless Lira even further down and put even more pressure on Erdogan and his Muppet show.

He is such an amateur :-)

We do make mild sanction and hardly none risk investments.

cheese and dementia –investment for jens