Written by Saxo Group’s Jack Davies; Originally appeared at TradingFloor.com

- Last year was the Damascus Securities Exchange’s busiest on record

- The majority of shares traded on the exchange are in foreign-owned banks

- Those banks are grossly overvalued by “financial engineering”

- Increased activity could suggest improved confidence in the Syrian economy

- But it could also suggest Syrian investors’ lack of alternatives

Forces loyal to the Assad regime have made considerable gains in recent months. On the surface this appears to be reflected on the Syrian stock exchange – but all is not as it seems.

Despite enduring more than half a decade of conflict leaving an estimated 400,000 dead and 11.4 million displaced, Syria retains an active stock market.

Established as part of a programme of economic reforms, the Damascus Securities Exchange opened its doors in 2009, two years before the onset of the crisis.

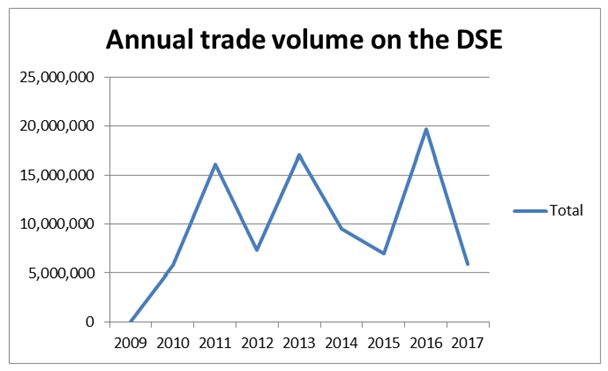

Not only does the market continue to function despite the conflict, if data published daily on the exchange’s website is to be believed, last year was its most active on record in terms of volume of trades and 2017 looks set to be busier still.

Source: Damascus Securities Exchange (2017 data only reflects the first month and half of trading, of course.)

While under ordinary circumstances, such data might be interpreted as suggesting renewed confidence in the economy; the circumstances in Syria are far from ordinary and analysts say activity on the exchange are largely the product of a fiction.

“Measured in the number of shares traded, the volume may be up but their value is down significantly, even when denoted in Syrian pounds,” Dr Reinoud Leenders of Lebanon and Syria Research Group tells TradingFloor by email. “Market capitalisation may seem to be on the rise but this hardly reflects real economic terms due to very high inflation and the steep fall in the exchange value of the Syrian pound.”

The Syrian pound has fallen dramatically since the start of the conflict. In 2010, you would have needed just shy of £50 to buy $1; today you would need more than £500 to get your hands on $1.

Subdued activity

Additionally, Leenders points out, there are only about half a dozen stocks that are actively traded on the exchange. Almost all of them are subsidiaries of foreign banks.

Rashad al-Kattan is a graduate of Damascus University. Now based in the UK, he works as a risk analyst and holds a fellowship at St Andrews University’s Centre for Syrian Study. Having previously worked for Lebanese-owned banks in Syria, the bulk of his academic research focuses on his homeland’s banking sector and stock exchange.

“If you look at the indices, banks are the most traded,” says al-Kattan. “I would be surprised if those investors are actually doing any due diligence because the banks – and this was acknowledged by the exchange’s general manager – although they appear profitable, they are engaged in financial engineering.”

Al-Kattan recounts how his former colleagues who were once employed by the corporate services department of their banks are now in the loan recovery department, which he says reflects the reality that – for the time being, at least – profit generation has all but ceased within the banks and in its place is loss reduction.

While attempting to identify their few remaining borrowers able to repay their loans is one way of attempting to reduce their losses, al-Kattan says a more efficient and insidious technique is also being employed.

“[The banks’] equity is paid in US dollars. What they’ve been doing each year is recognising those dollars in Syrian pounds, and because the pound is depreciating it seems their profits are going up,” says al-Kattan. “Of course, in order to do that you have to engage in a transaction; but the Central Bank has been very lenient with that because they don’t want to make the banks look loss making and generate panic.”

The banks in question are, of course, obliged to submit quarterly reports and statements, which contain these fictional profits.

“Their statements are endorsed by international auditing firms. They’re not saying anything because they know how the game is played. Looking at those banks, as an investor, I would not think they’re a good investment.”

But if the valuation of the banks is so inflated, why would anyone bother to invest in them? One answer, according to Kings College’s Dr Leenders is that both bankers and investors haven’t got anywhere else to go.

“Both are glued to the regime’s survival and/or are curtailed in their decisions by international sanctions,” he says in emailed remarks. “In this context, putting their money in either real estate or banks seems a sensible strategy, exactly because the rest of the economy fails (for now) to provide alternatives.”

Room for optimism

And while both Leenders and al-Kattan agree that the Syrian economy is in tatters, there are some causes for optimism for those who have bet their money on it recovering.

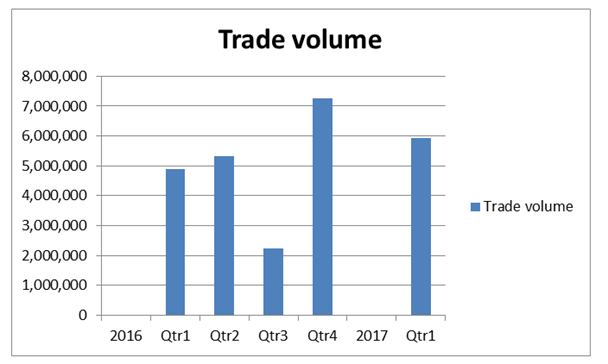

The rebound in trading on the Damascus Securities Exchange does coincide with the arrival of a large amount of Russian air and ground forces in Syria, and the re-capture of Aleppo by regime-aligned forces in December coincided with a massive uptick in trades on the exchange in the last quarter of 2016.

Source: Damascus Securities Exchange.

“But assuming that the banks are indeed banking on a regime victory (and henceforth in this context hoping for a likely influx of aid and remittances for recovery), this doesn’t mean the conflict is expected to come to an end,” says Leenders. “I guess from a banker’s perspective all that matters is that the regime captures and consolidates control in key economic areas; the rest of the country could still be under rebel control.”

Although hopes of an uptick in aid might be not be realised as soon as those banks would hope. The Syrian minister of economy announced recently that any reconstruction contracts awarded to foreign companies would be contingent upon apologies from Europe and the US for their role in the conflict, the Syria Report said this week.

Another indication that perhaps things may be on the verge of looking up for Syrian investors is that the construction of a 701 megawatt power station south of Damascus by Athens-headquartered international engineering firm Metka is reportedly nearing completion.

On Wednesday, Syriatel – one of the country’s two mobile phone service providers, headed by the president Bashar al-Assad’s maternal cousin Rami Makhlouf – signed an agreement with the exchange to list its shares publicly.

Al-Kattan, too, does not believe the economic situation is going to get any worse: “Generally speaking, I don’t think the Syrian pound will suffer more. I think in the next few months it will improve and might even go back to 400 [per dollar] with foreign cash injections,” he says.

But in terms of the stock exchange’s viability, he is not so optimistic. With 90% of the population dependent on foreign or government aid for survival and less than a fifth of the population even holding bank accounts, the exchange will continue to find itself with a limited base of investors, he says.

“How will it develop? Not a lot better than what we’ve seen before,” he says. “In terms of raising capital, we’re still a long way from that.”

Al-Kattan says that one of the reasons he chose to focus his research on the Syrian economy and in particular its banking sector is that “everyone is obsessed with ISIL and military balance of power and no one is focused on the economy.”

“I think this is important. While we’re talking about dealing with the regime, people believe the banks they dealt with before the conflict are the same, but I would argue they present very substantial risks.”

Representatives of the Damascus Securities Exchange acknowledged but did not respond to multiple requests for comment.

Syria’s stock exchange is far from being built on solid foundations.

Wow “While we’re talking about dealing with the regime” , “Forces loyal to the Assad regime”, ”

re-capture of Aleppo by regime-aligned forces”….

I mean seriously, the dude which wrote this article clearly prefers ISIS economy, you know, hostage taking, oil smuggling, extortion, all stock exchange in golden coins etc… clearly radical islamist fan, haven’t seen an article bout stock market being so politicized”

Syria is an independant sovreign nation. It has an elected parliament, a government, cabinet of ministers, and public service agencies. Syria also has an elected head-of-state, President Assad. Would it kill this Syrian expat to use correct language for once instead of partisan name-calling ?