Written by Dr. Leon Tressell exclusively for SouthFront

“Those whom the gods wish to destroy they first make mad”

You can taste the fear as global central banks panic and introduce emergency measures to prevent a systemic collapse of the global financial system. On Sunday the U.S. Federal Reserve launched another financial bazooka at stock and bond markets when it announced the start of QE 4. This will involve the purchase of $700 billion of government bonds/mortgage backed securities and a 1% interest rate cut taking them to zero.

Today the ECB has announced another $112 billion to be made available to banks while the Bank of Japan has declared that it will spend trillions more on purchasing bonds and exchange-traded funds.

This gigantic package of stimulus measures comes on top of the panic measures introduced last week as the meltdown in stock and bond markets began to get out of control. Last Thursday, as the bond market melted down and lines of credit were under threat the Fed announced an intervention in the short term debt markets (repo) that will run into April and amounts to over $4.5 trillion.

Last Thursday’s panic measure backfired as the Dow Jones plunged over 2000 points.

Financial analyst Wolf Richter, who has recently shorted the markets with some success, commented:

“This is the Fed’s latest effort to bail out Wall Street, the cherished asset holders that are so essential to the Fed’s “wealth effect,” all repo market participants, the banks, and the Treasury market that suddenly has gone haywire. Lots of things have gone haywire as the Everything Bubble unwinds messily.”

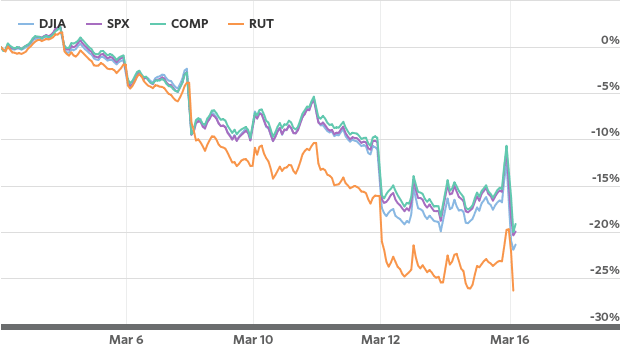

Flash forward to today and markets are reacting badly to the latest panic measure. At the opening of trading today stocks immediately crashed triggering circuit breakers that halted trading. The S&P 500 -9.8% 220 points or 8.1% down while the Dow Jones -10.5% plummeted 2, 250 points or 9.7% down. Meanwhile, the Nasdaq -9.83 dropped 482 points or 6.1% down.

The epic collapse of U.S. stock markets in shown in the chart below from Marketwatch:

This meltdown has been repeated on stock markets around the world. As if this wasn’t bad enough oil prices have fallen below $30 dollars a barrel while the scramble for cash has led haven assets such as gold to tumble in price today.

Sven Heinrich of Northman Trader has called this market to perfection and explained how global central banks are responsible for the current financial crisis through their reckless money printing measures since the 2008 economic crisis.. On twitter today he warned:

“If they can’t control markets today they should just shut it down until things can get sorted. They’re risking major fund blow ups and irreparable damage with consequences felt for a long time even if coronavirus gets sorted.”

The Federal Reserves announcement of QE4 on Sunday illustrates how frightened the central banks are of the major economic recession ahead. Highly respected economist Mohammed El-Arian, Allianz Chief Economic Advisor, has explained the Fed’s decision to launch massive monetary stimulus in simple terms:

“The fundamentals went from flashing red to constant red over the weekend.”

O’Rourke puts the failure of central bank intervention into its historical context:

“We thought the panic peaked on Thursday, when most of the country started to shut down, but that was eclipsed tonight by the Federal Reserve. All of us have just witnessed a central bank expend all of its conventional and unconventional tools to support an equity market that is less than a month from all time highs.”

Howard Gold of Marketwatch sums up why markets across the world continue to collapse:

“Bottom line: Investors don’t think the Fed’s moves are enough.”

The political and economic elites of the American empire have boxed themselves into a corner and created an economic hurricane that threatens an economic depression similar to the 1930s.

Since 2008 the Federal Reserve has presided over a gigantic wealth transfer as its massive money printing led to massive price inflation in paper assets across the board from stocks to bonds. The 1% have raked in massive profits while income levels for the majority have stood still or declined.

It has kept interest rates at historically low levels enabling banks, hedge funds and corporations to gorge themselves on cheap debt and engage in a frenzy of stock buybacks to the tune of several trillion dollars. These stock buybacks have artificially inflated the price of stock market shares while insiders sell at high prices.

Despite the current turmoil in financial markets the largesse of the Fed knows no bounds as it bails out its corporate masters.

The U.S. government which acts on behalf of corporate America, just like the Fed, is bankrupt and has a $23 trillion deficit that is growing exponentially. Trump’s $1 trillion tax giveaway in 2017 that largely benefited the super rich and corporate America has left the U.S. government with annual trillion dollar deficits. Many economists argue that Washington has little room for the massive stimulus needed to combat the impacts of the current pandemic.

Howard Gold of Marketwatch sums up the predicament of the American empire in rather sombre terms:

“As investors clamor for some kind of certainty — or at least leadership —the Fed is out of ammo, the federal government is fiscally tapped out, and the factionalism Washington and Madison warned about is tearing the country apart. Yes, indeed, the chickens are coming home to roost, but this time they’re infected by a deadly virus.”

Buckle up, for we have entered an unprecedented period of turmoil and volatility which will shake the global economy to its foundations.

The current panic rates cuts and massive money printing by global central banks and the stimulus measures of governments everywhere are just the beginning of this crisis. Expect bail outs galore as industry after industry screams for government/central bank assistance.

It would appear that the solution to $250 trillion of unpayable global debt is to hit the printing presses hard and create a whole load more cash out of thin air.

As businesses of all size go bankrupt while job losses and pay cuts rise over the next period I wonder if central banks generosity will extend to ordinary citizens?

As the global economy shuts down we will rapidly slide towards a major recession that will shake up geo-politics and lead us into even more uncertain times.

It’s all a scam to cover for the global crash that on the way anyway. This is now medical martial law to stop us dragging the politicians and bankers out of the luxury and hanging them. PRINTING MONEY IS STEALING!!!!!!!!!!!!!!!!!!!!!! FROM US and they are giving it away to the corporations and banks…….AGAIN!!!!!!

Bingo.

They might have deliberately released a real virus tho…

I think that virus was trigger not the cover. USA and EU markets had to crush in autumn 2019 but FRS started silent QE. But you can’t pull the spring endlessly. And BTW it’s not AGAIN. 2008 crisis never stopped.

Markets should have crushed much earlier (around 2017) but too many people were expecting it & waiting for the Banksters to make their move…COVID-19 turns out to be the perfect cover…

MORE AMERICUNTS WILL DIE THAN ANYWHERE ELSE

Even the WHO just launching a scathing account of the dumbass evil

selfish Americunts, to quote the Director General, ” it is becoming

increasingly apparent that the United States which has the highest

military spending is woefully unprepared for COVID-19 or any pandemic as

its privately managed health care system does not serve the majority of

its people, and this will unfortunately result in massive fatalities”.

Yes, IF the 2008 crisis had been repaired, interest rates would have returned to the Mathematic ‘ mean’ of circa 7%.

Any word with “meggedon” strikes a chord with me.

just watching the fabric of society catch a flame. it’s a beautiful sight

You are part of society, bro. When state becomes impotent, ordinary people still respect the law, while all kind of gangs are not restrained by law anymore. Chaos means mass massacre for the modern Western society and I think you won’t be the one on the gangs side.

nah, am in UK,. buses still run, people still shop

tesco and aldi’s are still around the corner. open

so is the pub that is literally across the road

we all stocked up on popcorn and dorito’s we get colds and flu all the time in England

Not trying to brag, but i was washing my hands and wiping my arse with toilet paper long before it was trending

LOL

There will always be British

Yeah. British called Ahmed.

I’m watching it, but also the common folk will suffer, don’t forget.

satire. most people are just chilling. day off work, can stock up on cheap petrol. watch netflix, surf online, ignore the government and go to the pub

government says dont smoke weed as well, i ignore that stupid rule too

if you are tested positive for coronavirus, head to your nearest mosque and stay there. cough on everything

You ARE silly! Do you live in the UK? I live in Missouri, US, thank God, not in a big city. We are out of toilet paper on the grocery store shelves.( I thought that was pretty funny.) Looks like i’m spending my day on South Front!

https://summit.news/2020/03/16/video-man-interrupts-live-news-broadcast-to-blame-media-for-coronavirus-hysteria/

The guy is kinda right, too. We have one presumed case in our town, from someone who had just got back from Austria. The person is quarantined. And everybody is going nuts. I’ve got to go tomorrow and try to buy cat food. I have three strays who depend on me. :(

One presumed case is not bad.

Cats love KFC or El Pollo Loco drive thru. :)

Toiletpaper…up here in Holland all the Toiletpaper is gone as well….yeah that is exactly what you need in any Survival situation….bwahahahahaha…them Sheeples are so funny….In any Doomsday-Scenario they will really panic once they realize all their toiletpaper is gone….

The Toiletpaper-Prepper

OMG! No toilet paper in the whole world! What will we do? Hahahahahahahaha! Fortunately, some of us have lived in the woods. (The poor city folk are going to have to scrounge for some grass from somewhere.)

I went out yesterday at 6:00 AM to check out a couple of large markets. They have compressed their hours to 8AM to 9PM to try to restock and clean the stores, so I turned around and went home. Important not to join a dense herd of panicked shoppers. I have a large supply of canned goods, will wait out this madness. :)

Good idea. Surely it will pass, even with the Lord’s coming.

Toilet paper is gone here in Canada too …. as well as frozen entrees and potato chips (storm chips as we call them). Surprisingly dried beans, pasta, rice, flour and coffee are hardly touched …. tells you something about society today don’t it? I’m still trying to find a good recipe for TP …. maybe they just have it raw with peanut butter?

Wayne, you have a hell of a lot of trees up there. Please expand paper products and forget about tar sands for right now since that price is not paying off right now ! :D

100% bro. I have bags of 100% raw, organic, GMO free artisanal toilet paper from my planer just sitting in my dust collector that I’m planning on selling on Craigs list when the stores run dry.

Seriously though this pandemic should be a wake up call. We are using oil up without thinking that future generations may have a use for it at some point. They are saying now that this virus could be with us for 3 years circling the globe in waves. If for example a virus as contagious as Covid-19 but as deadly SARs emerges our society will be knocked back to the dark ages. Having an energy resource like coal and oil would be vital to society …. you don’t just jump from wood fires to nuclear fusion. leaving a little in the ground for our great grandchildren would be prudent instead of just burning it as fast as we can …. especially since we have alternatives.

Even the argument that oil is abiotic and unlimited doesn’t account for the fact that we’ve used up all the easily accessible oil and our grandchildren may not have the technology to exploit shale oil or do offshore drilling.

Hahahaha! Ikr? People are stocking up on water here, too. in case the water for some reason gets turned off. (?) But I’ve got plenty of beans and rice and other staples. And cast iron skillets and a fireplace and wood, and kerosene lamps and candles in case the electricity goes. (But I don’t know why it would,unless, you know, the whole society as we know it crashes.)

If that happens, we won’t be able to communicate. In which case, via con Dios, all, I suppose even the trolls.

Me too. I’m not a prepper by any stretch but I’m pretty self sufficient. I grow veggies and have a good sized root cellar and a couple of freezers so I can put enough away for the year. I also grow sprouts and herbs year round. The only veggies I buy are mushrooms and the odd special treat I need for a special recipe. I also make my own kimchi and Sauerkraut every fall.

I’d like to get some chickens and goats but there too much trouble at the moment and we have far too many eagles and foxes prowling around.

I have a propane powered standby genny and a months worth of fuel on hand just in case

Sounds like you’re in good shape. If you live out where there are foxes and eagles, you must live where you could hunt, if need be, for meat (deer). If you aren’t vegetarian, of course.

I’m not a vegetarian but I don’t eat meat every day either. I could never quit bacon. I used to hunt from when I was a kid but I moved away to work and just never had time for it. I don’t even own a gun any more. That being said we have a lot of deer around here. I got 2 deer trails crossing my property and you can barely leave the house without seeing a deer. Got a major river runs right in front of my house and a few good trout streams nearby as well.

I’m not buying a gun yet but I’m considering it. I’m pretty sure I could still skin and butcher a deer…. there’s always youtube.

Maybe it would be a good idea to buy a rifle before Gun Shows are outlawed. :) With your freezers you could stock up on deer meat. If I had a pick-up truck instead of a car, I’d go hunting. Besides, if the SHTF, you’ll need a rifle if not a hand-gun. .

Stup11d just use water is more clean too.

Don’t worry, Turk, us country folks can survive: https://youtu.be/3cQNkIrg-Tk?t=2

Try using big leaves or wiping your bottom on the grass, Karen :)

Very polite answer, thank you, Florian. (Heh heh.)

Pube will be shutting their doors very soon.

But what about drive thru and take-out, Florian ? :D

That’s a grey area. And many restaurants are also take-aways .

There will be riots for certain if people are literally fighting over toilet paper :)

Perhaps this is needed to remove the shite political leaders we have had for generations.

Debt will be the killer for many and the state can easily manipulate citizens with debt.

If they take our pensions, or Social Security, as you mentioned before, we’re screwed. We won’t be able to buy food, much less pay our bills.

People complaining on the toilet paper hoarding should start looking at a bidet.

Fractional reserved banking system has closed it’s fist and gone elbow deep into the arse of western populations wealth in this latest harvest

They will never admit that there is a structural problem. Stock market Dow Jones index since the 2008 crisis quintupled. that’s 400% increase. While the GDP just went 38%. Something is not right.

A lot of that increase was due to stock buyback schemes. A company borrows the cheap money the fed is printing and uses it to buy back their own shares. This artificially inflates the share price and the preferred shareholders get a dividend and the executives whose bonuses are tied to stock price get a big fat cheque. Boeing, GE, Apple, Pepsi and Alphabet all do this among many others.

Boeing for example has been doing this practice and all the gains they’ve made were lost over the last 2 weeks …. but they still owe the money they borrowed at a time when they need every nickel of cash they can scrape together.

When all is said and done it’s going to take a decade to recover from this.

The 1 trillion Dollars tax break for the rich is also factored in. And they can’t even call it back, there is no profit to tax right now (nor for the next 3 years).

The US can recover if they let go of market manipulations, money printing and useless expenses like foreign interventions. If they don’t, they will go bankrupt and several sates will leave the union. There will be no USA.

What’s worst is that it’s not even the end of it. Worse things will be coming.

CORONA IS A VERY NICE EXCUSE FOR AN ECONOMIC CRISIS THAT SHOULD HAVE HAPPENED IN 2017….

I am an avid board game player. I’m not much for theclassics like chess or go, preferring the more modern ones. But,regardless, as a person who appreciates the delicate balance betweenstrategy and tactics, I have to say I am impressed with RussianPresident Vladimir Putin’s sense of timing.

Because if there was ever a moment where Putin and Russia could inflict maximum pain on the United States via its Achilles’ heel, the financial markets and its unquenchable thirst for debt, it was this month just as the coronavirus was reaching its shores. Like I said, I’m a huge game player and I especially love games where there is a delicate balance between player power that has to bemaintained while it’s not one’s turn. Attacks have to be thwarted just enough to stop the person from advancing but not so much that they can’t help you defend on the next player’s turn.

All of that in the service of keeping the game alive until you find the perfect moment to punch through and achieve victory. Having watched Putin play this game for the past eight years, I firmly believe there is no one in a position of power today who has a firmer grasp of this than him. And, I do believe this move to break OPEC+ and then watch Mohammed bin Salman break OPEC was Putin’s big judo-style reversal move. And by doing so in less than a week he has completely shut down the U.S. financial system.

On Friday March 6th, Russia told OPEC no. By Wednesday the 11th The Federal Reserve had already doubled its daily interventions into the repo markets to keep bank liquidity high. By noon on the 12th the Fed announced $1.5 trillion in new repo facilities including three-month repo contracts. At one point during

trading that day the entire U.S. Treasury market went bidless. There was no one out there making an offer for the most liquid, sought-after financial assets in the world. Why? Prices were so high, no one wanted them. Not only did we get a massive expansion of the repo interventions by the Fed, but it was for longer duration. This is a clear sign that the problem is nearly without an end. Repos longer than three days are in this context a rarity. The Fed needing to add $1 trillion in three-month repos clearly means they understand that they are looking out to the end of the quarter as the next problem and beyond that.

It means, in short, the world financial markets have completely seized up. And worse than that…. It didn’t work. Stocks continued to slide, gold and other safe-haven assets were hit hard by a reversal of capital outflows from the U.S. In the first part of the aftermath of Putin’s decision the dollar got whacked as European and Japanese investors who had piled into U.S. stocks as a safe-haven sold those positions and brought the capital home. That lasted a few days before Christine Lagarde put on her dog and

pony show at the European Central Bank and told everyone she didn’t have any answers other than to expand asset purchases and continue doing what has failed in the past. This touched off the next phase of the crisis, where the dollar begins to strengthen. And that is where we are now. And Putin understands that a world awash in debt is one that cannot withstand the currency needed to repay that debt rising sharply. That puts further pressure on his geopolitical rivals and forces them to focus on their domestic concerns rather than the ones overseas. For years Putin has been begging the West to stop its insane

belligerence in the Middle East and across Asia. He’s argued eloquently at the U.N. and in interviews that the unipolar moment is over and that the U.S. can only maintain its status as the world’s only super power for so long. Eventually the debt would undermine its strength and at theright moment would be revealed to be far weaker than it projected. This doesn’t sit well with President Trump who believes in America’s

exceptionalism. And will fight for his version of “America First’ to thelast using every weapon at his disposal. The problem with this ‘never back down’ attitude is that it makes him very predictable. Trump’s use of sanctions on Europe to stop the Nord Stream 2 pipelinewas stupid and short-sighted. It ensured that Russia would be merciless in its response and only delay the project for a few months. Trump was easy to counter here. Sign a deal with Ukraine, desperate for the money, and redirect the pipe-laying vessel back to the Baltic to finish the pipeline. And with natural gas prices in Europe already in the gutter from oversupply and a mild winter, there isn’t much time or money lost in theend. Better to take the world oil price down well below U.S. production costs which ensure that Trump’s prized LNG stays off the European market as the myth of U.S. energy self-sufficiency vanishes in a puff of financial derivative smoke. Now Trump is facing a market meltdown well beyond his capacity to fathom or respond to. While Russia is in the unique position to drive costs down for so many of the people while riding out the shock to the global system with its savings. Because money flows to where the best returns on it come, high oil

and gas prices stifle development of other industries. Lowering the oil price not only deflates all of the U.S.’s inflated financial weapons it also deflates some of the power of the petroleum industry domestically.

This gives Putin the opportunity to continue remaking the Russianeconomy along less focused lines. Cheap oil and gas means lower return on investment in energy projects which, in turn, opens up available

capital to be deployed in other areas of the economy. Putin just told the world he’s not riding his country’s oil and gas resources like a cash cow but rather as an important part of a different economic strategy for Russia’s development. It’s like watching someone playing the first half of a game implying

one strategy and making a critical shift to a different one halfway through, taking advantage of their opponents’ carelessness. It rarely works, but when it does the results can be spectacular. Game, Set, Match, Putin The above analysis is by Tom Luongo and you can locate him at…. https://www.strategic-culture.org/contributors/tom-luongo/#articles

Am reposting the below ’cause it was “detected as spam and they are working on it” I am an avid board game player. I’m not much for theclassics like chess

or go, preferring the more modern ones. But,regardless, as a person who

appreciates the delicate balance betweenstrategy and tactics, I have to

say I am impressed with RussianPresident Vladimir Putin’s sense of

timing.

Because if there was ever a moment where Putin and Russia

could inflict maximum pain on the United States via its Achilles’ heel,

the financial markets and its unquenchable thirst for debt, it was this

month just as the coronavirus was reaching its shores. Like I said, I’m a

huge game player and I especially love games where there is a delicate

balance between player power that has to bemaintained while it’s not

one’s turn. Attacks have to be thwarted just enough to stop the person

from advancing but not so much that they can’t help you defend on the

next player’s turn.

All of that in the service of keeping the game

alive until you find the perfect moment to punch through and achieve

victory. Having watched Putin play this game for the past eight years, I

firmly believe there is no one in a position of power today who has a

firmer grasp of this than him. And, I do believe this move to break

OPEC+ and then watch Mohammed bin Salman break OPEC was Putin’s big

judo-style reversal move. And by doing so in less than a week he has

completely shut down the U.S. financial system.

On Friday March 6th,

Russia told OPEC no. By Wednesday the 11th The Federal Reserve had

already doubled its daily interventions into the repo markets to keep

bank liquidity high. By noon on the 12th the Fed announced $1.5 trillion

in new repo facilities including three-month repo contracts. At one

point during trading that day the entire U.S. Treasury market went

bidless. There was no one out there making an offer for the most liquid,

sought-after financial assets in the world. Why? Prices were so high,

no one wanted them. Not only did we get a massive expansion of the repo

interventions by the Fed, but it was for longer duration. This is a

clear sign that the problem is nearly without an end. Repos longer than

three days are in this context a rarity. The Fed needing to add $1

trillion in three-month repos clearly means they understand that they

are looking out to the end of the quarter as the next problem and beyond

that. It means, in short, the world financial markets have completely

seized up. And worse than that…. It didn’t work. Stocks continued to

slide, gold and other safe-haven assets were hit hard by a reversal of

capital outflows from the U.S. In the first part of the aftermath of

Putin’s decision the dollar got whacked as European and Japanese

investors who had piled into U.S. stocks as a safe-haven sold those

positions and brought the capital home. That lasted a few days before

Christine Lagarde put on her dog and

pony show at the European

Central Bank and told everyone she didn’t have any answers other than to

expand asset purchases and continue doing what has failed in the past.

This touched off the next phase of the crisis, where the dollar begins

to strengthen. And that is where we are now. And Putin understands that a

world awash in debt is one that cannot withstand the currency needed to

repay that debt rising sharply. That puts further pressure on his

geopolitical rivals and forces them to focus on their domestic concerns

rather than the ones overseas. For years Putin has been begging the West

to stop its insane belligerence in the Middle East and across Asia.

He’s argued eloquently at the U.N. and in interviews that the unipolar

moment is over and that the U.S. can only maintain its status as the

world’s only super power for so long. Eventually the debt would

undermine its strength and at theright moment would be revealed to be

far weaker than it projected. This doesn’t sit well with President Trump

who believes in America’s exceptionalism. And will fight for his

version of “America First’ to thelast using every weapon at his

disposal. The problem with this ‘never back down’ attitude is that it

makes him very predictable. Trump’s use of sanctions on Europe to stop

the Nord Stream 2 pipelinewas stupid and short-sighted. It ensured that

Russia would be merciless in its response and only delay the project for

a few months. Trump was easy to counter here. Sign a deal with Ukraine,

desperate for the money, and redirect the pipe-laying vessel back to

the Baltic to finish the pipeline. And with natural gas prices in Europe

already in the gutter from oversupply and a mild winter, there isn’t

much time or money lost in theend. Better to take the world oil price

down well below U.S. production costs which ensure that Trump’s prized

LNG stays off the European market as the myth of U.S. energy

self-sufficiency vanishes in a puff of financial derivative smoke. Now

Trump is facing a market meltdown well beyond his capacity to fathom or

respond to. While Russia is in the unique position to drive costs down

for so many of the people while riding out the shock to the global

system with its savings. Because money flows to where the best returns

on it come, high oil and gas prices stifle development of other

industries. Lowering the oil price not only deflates all of the U.S.’s

inflated financial weapons it also deflates some of the power of the

petroleum industry domestically.

This gives Putin the opportunity to

continue remaking the Russianeconomy along less focused lines. Cheap

oil and gas means lower return on investment in energy projects which,

in turn, opens up available capital to be deployed in other areas of the

economy. Putin just told the world he’s not riding his country’s oil

and gas resources like a cash cow but rather as an important part of a

different economic strategy for Russia’s development. It’s like watching

someone playing the first half of a game implying one strategy and

making a critical shift to a different one halfway through, taking

advantage of their opponents’ carelessness. It rarely works, but when it

does the results can be spectacular. Game, Set, Match, Putin The above

analysis is by Tom Luongo and you can locate him at….

LewRockwell.com The Real Crisis Starts Now in Europe https://www.lewrockwell.com/2020/03/thomas-luongo/the-real-crisis-starts-now-in-europe/

Luongo’s site is “Gold, Goats ‘n Guns”. This is probably a different article from the one you reference, though.

Thank you, Redadmiral, I see we are headed for a severe Depression. Wish I had some acreage and animals. I’ve got a garden spot and seeds, but no meat. But, in Missouri there are lots of ranchers who will need cash. If we have any cash, we can buy some meat. The small farmers in the Depression of the ’30’s survived. They didn’t have cash, but they had land and food.

Today at Walmart from the epicenter of the US coronavirus outbreak.

https://uploads.disquscdn.com/images/f1bb47024dd5579ce0b28c2ba4dc65b22b0522f4e3d54a06051720191380dd0a.jpg

Today at Walmart. https://uploads.disquscdn.com/images/d84242a78515422f84401c726ef47e8581c564ccae0cbdca97f1d637a1edc316.jpg

Today at Walmart.

https://uploads.disquscdn.com/images/219f1a49b5f5765b3c13750f480ddee4d03c41286a5b745e26c151ab89e42a07.jpg

Toilet paper distribution warehouse:

https://uploads.disquscdn.com/images/f08e96d7cec2795e9fb38eaaeb227eab0872d25f200e51efda570348383e7264.jpg

No, just kidding. Waiting for some truck drivers who want some over time pay. :)

Wow, they bought nearly all the sandwich meat. People simply don’t cook anymore. ‘Course, if kids are home from school, they have to eat something and sandwiches are what they’re used to. No wonder all the chips are gone!

Bread, meat and canned goods were in big demand.

https://southfront.org/wp-content/uploads/2020/03/1-69.jpg

3% to 15% of the US population gets the flu every year.

https://www.cdc.gov/flu/images/about/burden/Influenza-Chart-Infographic-high-res.jpg

Yes, it’s a scam.

My gross income to the rideshare car that I’m driving has dropped from $1,450.00 two weeks ago to $950.00 last week. Last night I grossed $80.00 for 11.5 hours online. It was double that for a Sunday night before they started implementing the containment measures two weeks ago.

Sorry to learn this, Richard!

” The 2020s threaten to be a repeat of the 1930s when international relations broke down and the economic crisis was of such severity it left the major powers with no other recourse but war to try and solve their intractable problems.”

The BIG difference if war is used by the US in an attempt to solve the current American debt problem, is that today the US mainland WILL suffer great war damage. Whereas in WW1 and WW2, the US arms sales hugely enriched the US economy and the US mainland was unscathed.

The WW2 UK debt for armaments was not paid off until 2006.

Well, this is simply how capitalist economies work. Financial bubbles inflate until they burst, causing chaos, only to then reinflate yet again. The US stock market in particular had massively inflated up into the stratosphere — a major crash was inevitable. That combined with the crashing oil markets, rising debts, and a potential lock-down of society due to coronavirus could very well cause a second Great Depression type event. People in the US are now hoarding like crazy (toilet paper, soap, and even various foodstuffs that can be stored long-term are flying off the shelves). This will not end well for the clueless, neo-liberal USA. The house of cards is falling.

Right now I am hoarding firewood to stay warm next winter.

Unused wood is very cheap with everybody going after toilet paper. :)

https://uploads.disquscdn.com/images/c91c97aed80bd86392e7f72ccf46402b9fd2a67de73211347effa2f8789eb961.jpg

Yeah, good idea. I’m sure you know how to cook on a wood stove, too. Pot of beans, or stew or whatever, on top. If you have cast iron pots, you can bake cornbread or biscuits in the coals-put coals on top of the pot so the bread cooks evenly. Cast iron frying pans and pots are sold at thrift stores, also “blue enamel” coffee pots. (Boil the water, throw in the coffee grounds, let it boil a few minutes, take off fire, throw in a little cold water to settle the grounds, voila, coffee.) ‘Course, I’m sure everybody on this site is pretty much a survivalist and knows this stuff. I’m sure the non-Western people already cook like this.

Perfect storm.

I think it has really hit the fan. Normally one or more central banks step in and straighten out the crisis …….. and then everybody goes back to the buffet line, the prostitues or whatever passes for their version of entertainment. This time, repeated big rounds thrown down rage by the Fed and EU have completely bounced off the beast. Trade wars, real wars, Russians under the bed nonsense, Russians saying no at he OPEC+ meeting ( that one was a hit by an RPG ), MBS nutting up and nuking OPEC, …… there is so much junk in the air that a way to get it under control is impossible. It has to run it’s course. And the virus, well it is meandering along quite nicely and shutting down everything that is still working. This is almost beyond belief but, it is all very real. Good luck out there folks. My sincere wish to all is, fare thee well.

I bet the preppers are having a blast with this.

was covid 19 created by the CIA in order to discredit trump? they r bumbling and incompetent…I would not be surprised

This quote helps explain the mortality rate scam that the msm and governments are running:

“How to calculate the mortality rate during an outbreak

At present, it is tempting to estimate the case fatality rate by dividing the number of known deaths by the number of confirmed cases. The resulting number, however, does not represent the true case fatality rate and might be off by orders of magnitude […]

A precise estimate of the case fatality rate is therefore impossible at present.”

– Coronavirus (COVID-19) Mortality Rate –

https://www.worldometers.info/coronavirus/coronavirus-death-rate/

The US CDC has developed mathematical methods for estimating flu mortality rates. These same models can and undoubtedly are being used to estimate the rate for the coronavirus as data comes in.

The estimating process, which goes far beyond dividing the number of tested cases by the number of deaths, and as such considerably lowers the mortality rate, can be viewed at this link:

https://www.cdc.gov/flu/index.htm

600,000,000 million people die on this planet every year from various causes. 6,000 have died from the coronavirus. How many more are governments and the msm going to kill from destitution and deprivation from their wanton destruction of theirs and the global economy? By the manner that they’re handling this disease.

I had a rideshare customer last night who told me that 2 of their relatives have recovered from the coronavirus. The wife was never hospitalized. The 61 year old husband with a stent and asthma was hospitalized for 2 days at the beginning of January weeks before the virus is officially declared to have been detected here, and was diagnosed with an unknown respiratory infection.

Two weeks ago their test results came back and the infection was determined to have been the coronavirus. If true, this confirms similar statements made by some government officials that the virus has been here for as long as it’s been in China.

Why has the problem been comparatively minimal here compared to other locations? Are accelerants being used to mass murder people in Italy, Iran and China?

unknown…some nations—latin amerikan, have few cases…today Italy, Iran r most effected