Written by Prof Michel Chossudovsky; Originally appeared at Global Research

Central banks in several regions of the World are building up their gold reserves.

A large part of these Central Bank purchases of gold bullion are not disclosed. They are undertaken through third party contracting companies, with utmost discretion.

The evidence amply suggests that US dollar holdings and US dollar denominated debt instruments are being traded in for gold, which in turn puts pressure on the US dollar.

In the course of the last ten years, both China and Russia have boosted domestic production of gold, a large share of which is being purchased by their central banks.

In the current context, these initiatives on the part of China and Russia are intended to challenge US dollar hegemony. There is an obvious strategic objective associated with the accumulation of gold reserves.

The objective of China and Russia is to build their national currencies under the gold standard, whereby the value of the yuan and the ruble would be linked to the price of gold. Both countries are dumping dollar denominated Treasuries. China is using its extensive treasury dollar reserves to finance large scale investments.

Dominance in physical gold reserves, however, does not necessarily ensure national sovereignty with regard to monetary policy (devoid of dollar hegemony) nor does it ensure control of the international gold market.

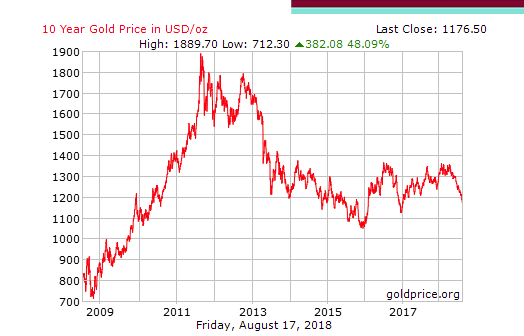

The price of gold is notoriously unstable. US financial institutions can act against Russia and China without actually possessing physical gold. They are able to influence the gold and foreign exchange markets through various speculative instruments including naked short-selling.

The gold market is not limited to the trade in physical gold. It is characterised by numerous paper instruments, gold index funds, gold certificates, OTC gold derivatives (including options, swaps and forwards), which play a strong role, particularly in short-term movement of gold prices. These instruments are routinely used to manipulate the market in physical gold.

It’s financial warfare: Those same speculative instruments are also available to Chinese and Russian financial operators including their central banks. Needless to say, they are acutely aware of the instability and manipulative environment which characterizes the gold market.

China: Largest Gold Producer

China is currently the World’s largest gold producer followed by Australia and Russia. “It has long been assumed that China is surreptitiously building up its gold reserves through buying local production”. But it is also investing in several gold producing countries.

Chinese companies are investing in gold mining in different regions of the World (including South Africa and Australia), largely with a view to establishing a global hegemony on the supply side. While China’s domestic production is high, its reserves are significantly lower than those of Australia, Russia and the U.S.

- Major Chinese firms will ramp up investment in foreign gold mines, ….

- Chinese firm Shandong Gold purchase of a 50% stake in the Veladero mine in Argentina from Barrick Gold for USD960mn. …

- state-owned China National Gold Group’s USD300mn purchase of the Jinfeng gold mine from Eldorado Gold and Indonesian firm PT Amman Mineral International’s USD1.3bn purchase of Newmont Mining’s Indonesian assets, …

- In 2015, China set up a new USD16.0bn mining fund to develop gold mining projects along the planned Silk Road infrastructure route. (See Fitch Solutions)

China and Russia are also collaborating in terms of joint ventures in gold mining

Graph for 2017: Wikipedia, quoting “Where Have All the Gold Mines Gone?” and “U.S. Geological Survey, Mineral Commodity Summaries” (PDF). USGS. 2017.

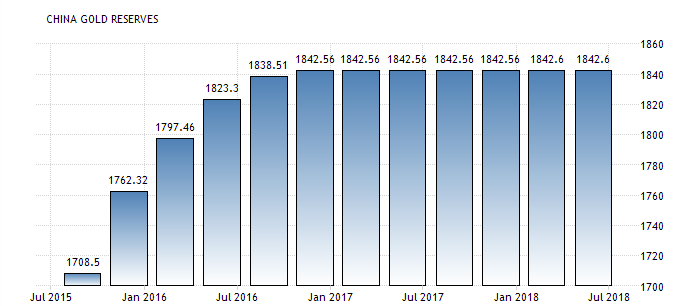

China’ Central Bank Reserves

China’s central bank gold reserves have increased from 600 tons in 2003 to 1054 tons in 2009. If we go by official statements, China’s gold reserves have tripled since 2003. They currently stand at 1842 metric tons (July 2018)

Russia

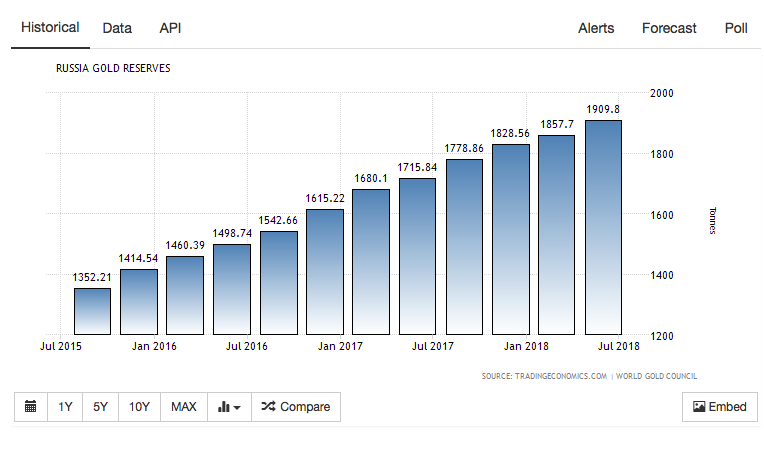

The Russian Central bank purchases gold from a Russian state company “Gokhran, which is the marketing arm and central repository for the country’s mined gold production”. Mineweb. Recent reports (April 2018) confirm that Russia purchased 300,000 troy ounces of gold in March 2018, i.e. 18.66 metric tons.

Russia’s Central bank holdings were in excess of 20 million troy ounces or 622 tons (January 2010). The latest figures (July 2018) confirm that gold reserves of the Russian Federation have more than tripled since 2010. They currently stand (July 2018) at 1909.8 tons. (see diagram below).

Turkey’s Gold Holdings

There has been an upward trend since January 2017. Turkish media Yeni Safak suggests that the Erdogan government had ordered in 2017 the repatriation of “all of its gold stored in the U.S. Federal Reserve” i.e. 220 metric tons.

The published World Gold Council figure for July 2018 is contradictory.

Gold Prices

As mentioned earlier, the sale and purchase of physical gold are not the only factor in explaining the movement of gold prices. The gold market is marked by organized speculation by large scale financial institutions.

The price of gold is an instrument of financial warfare. In the present context, Wall Street is intent upon manipulating the gold market.

That is one way to beat the dollar and probably the most straight forward. Only keep enough dollars to settle trades and use any excess dollars to buy gold. Later on you could sell off your gold into the currency of your choice.

I’ve always thought that the axis of resistance should establish one new currency with fractional backing in gold that is only used to settle international transactions with them. The problem I am addressing here is that the reason countries use dollars now is that most countries really do not want the local currency of another country suffering high inflation. Does Russia really want to sell Iran wheat in exchange for the Iranian Rial now, or take Venezuelan Bolivars? What is needed is a new currency that is non-inflationary.

This currency could be managed by countries based on how much gold they provide to back the new l currency. This currency can only be used to settle international trade so that the U.S. would not be able to use inflated value dollars to buy up the gold reserves by hoarding the new currency. The fractional amount of gold that backs this ‘dollar’ could be changed by the voting members to silence the ‘you are price fixing gold’ crowd.

It’s all a bit complex and beyond my knowledge to be honest, the outcomes of countries trading under a gold standard. What I do know though is that many countries are forced to hold dollar’s because of their debt obligations, and unless the US collapses then they will have to keep trading with it to not only pay back the principle, but ALSO the ever increasing interest payments.

It’s a nice idea, but I think it is unfortunately a long way off to be used globally. For the moment I predict it will be used by Eastern nations as a fair way to develop trade and keep their finances in check.

BTW, the curve ball I see in all of this is the money printing presses going into overdrive, not only the US but apparently also China, which also is printing on behalf of a number of SEA nations. Obviously this will have an affect on inflation.

The US is not the biggest gold producer in the world? Then WTF am I watching all those gold mining shows on the Discovery Channel for? ;-)

That young guy (Parker) with “big red”, beating their output year on year + of course that old git with a funny voice, as partner on 2 or 3 mines. If this “Gold Rush” goes on much longer, the whole of the US will look like a Nuke hit it; Christ they leave the land in a total shit state.

The old git is what a Dutchman sounds when he tries to talk English. ;-)

It’s good to see that I’m not alone in thinking stripmining like that has got to have a major environmental impact.

If you dump our dollar, we dump your gold………………………………………….LOL.