Originally appeared at ZeroHedge

Indian stocks crashed on Monday, suffering their worst single-day loss on record, as domestic and foreign investors were absolutely terrified that a nationwide lockdown triggered by a COVID-19 outbreak could crash the economy.

The NIFTY 50 is the flagship index on the National Stock Exchange of India, plummeted 12.98% to a near four-year low of 7,610.25 on Monday.

The Indian rupee hit a record low of over 76 against the dollar and puts pressure on the Narendra Modi government and the Reserve Bank of India (RBI) to ramp up emergency response efforts to protect a crashing currency and economy.

Modi’s “Make-in-India” program, an attempt to revive the economy and diversify its manufacturing sector away from automobiles to bolster its aerospace and defense sectors, has miserably failed.

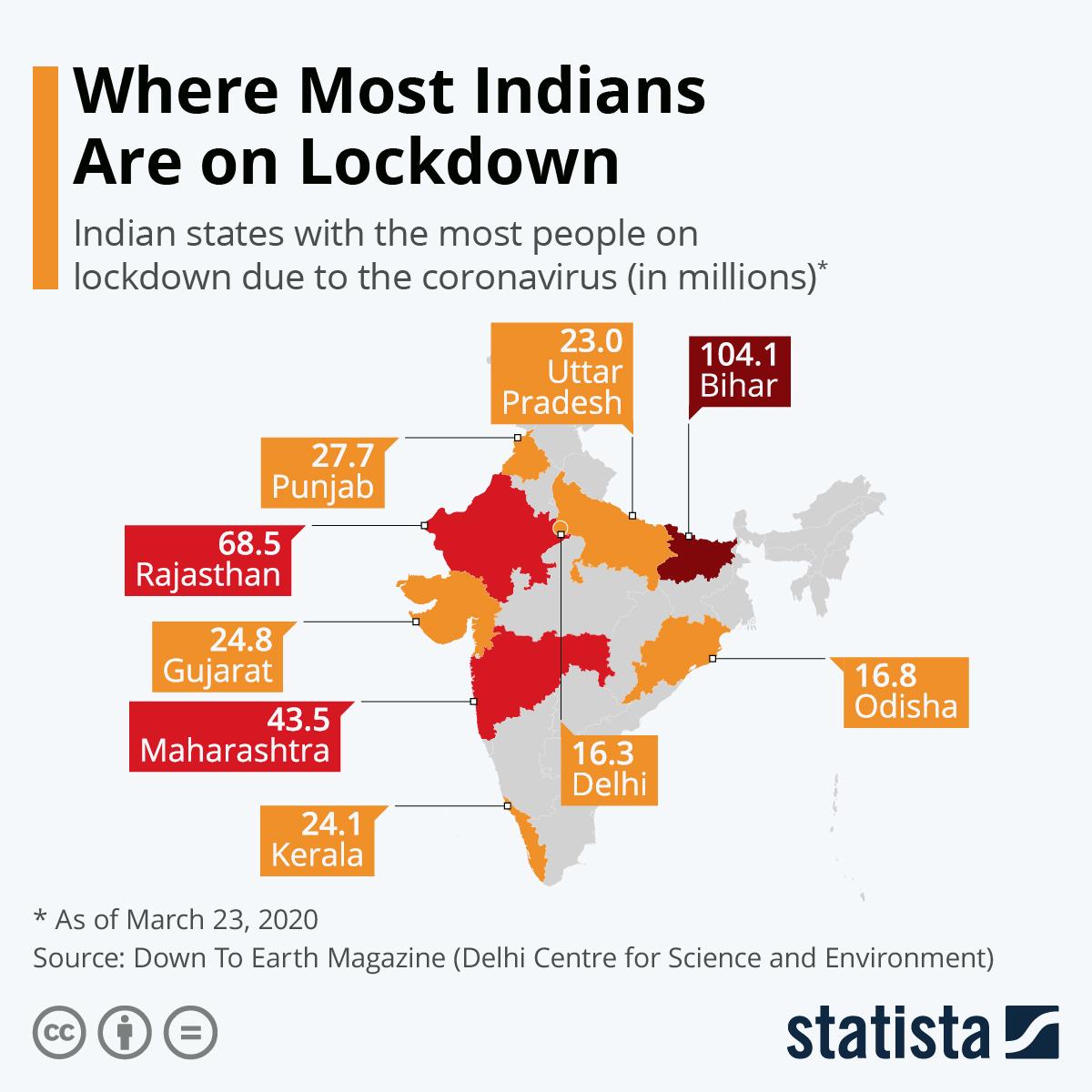

The economy has come to a screeching halt as residents in 75 districts across the country, including in major cities, such as the capital New Delhi, Mumbai, and Bangalore have been forced into mandatory quarantine by the government until March 31.

India is the second-largest country in the world, and has reported only 467 cases and ten deaths.

The lack of test kits has made it virtually impossible for the Ministry of Health and Family Welfare to detect community spreading of the virus. As test kits come online, India could be staring at a pandemic.

Actions by the government already suggest the virus crisis is getting worse. In the last day, India launched the world’s most extensive social distancing lockdown of 1.3 billion people to flatten the pandemic curve to slow down the infection rate.

https://twitter.com/AJEnglish/status/1241818049197617157

Flight bans and the cancellation of all passenger trains in the country is another attempt to limit the spread. The country’s hospital system is poorly equipped and doesn’t have enough hospital beds and ICU-level treatments to handle a massive influx of virus patients.

“This is the biggest lockdown in world history,” said Raghu Raman, a former soldier with the Indian Army and founder of the National Intelligence Grid, an umbrella database aimed at countering terrorism.

“This strategic pause gives decision-makers more time to arrest the exponential spread of the virus and evaluate tradeoffs.”

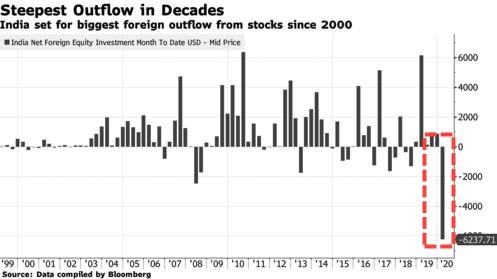

Foreign investors aren’t sticking around to see if the virus crisis will abate in the near term – they’re currently dumping Indian assets at an unprecedented pace.

Oxford Economics estimates India’s January-April growth forecast to be around 3%, a level not seen since the global financial crisis.

Bloomberg Economics says that the Indian government needs to spend at least 1% of GDP, or about $30 billion, to respond to the virus outbreak.

India’s manufacturing hubs have ground to a halt as companies have been forced to shutter operations for virus containment purposes. Maruti Suzuki India Ltd., Tata Motors Ltd., Toyota Kirloskar Motor, Hero MotoCorp., Samsung Electronics Co. and LG Electronics Inc., Mahindra Group, TVS Motor Co., Kia Motors Corp., Renault Nissan Automotive India Private Ltd., and Yamaha Motor India are some of the large multinationals that have recently suspended operations.

The government’s principal economic adviser Sanjeev Sanyal warned that “waves of default” of corporate debt could be imminent. There’s a record 5.9 trillion rupees of corporate debt maturing this year.

Finance Minister Nirmala Sitharaman said last week that the government would announce a relief package for companies in the near term. The RBI is expected to slash interest rates and inject 1 trillion rupees into the economy on April 3.

We noted back in December that India’s economy was “in a very deep crisis,” which was a month before the world figured out about a virus outbreak in Wuhan, China.

It was only earlier this month that India organized a rescue plan for the nation’s fourth-largest private bank as a long-running crisis among shadow lenders threatened to spill over into the banking system.

With a nationwide lockdown underway, India’s economy could be on the brink of a significant downturn that would be absolutely devastating for the Modi government.