Originally appeared at ZeroHedge

Overnight, the US Department of Treasury released the initial result of the 100-day Sino-China trade and economic negotiations, a month after the presidential summit at Mar-a-Lago in early April. Under the negotiations led by Steven Mnuchin and Secretary of Commerce Wilbur Ross in the United States and Vice Premier Wang Yang from China, the two countries reached agreements on some “early harvest” items and made progress on some key issues in agricultural trade, financial services, investment, and the energy area.

While there were no surprises in the agreement, whose terms had been leaked previously by the president himself, here are some of the key details per Citi:

- Consensus reached to open China’s market wider for US agricultural and energy products

On agricultural trade, China will allow imports of US beef on conditions consistent with international food safety and animal health standards and consistent with the 1999 Agricultural Cooperation Agreement, and will hold a meeting in May to conduct science-based evaluations of pending U.S. biotechnology product applications. Meanwhile, US promises to resolve the issue on importing cooked poultry products from China. In the energy field, US will treat China no less favorably than other non-FTA trade partners with regard to LNG export authorizations.

- China to give wider access for US financial services industry

Out of the ten bullets, half of them focus on financial services. By 16 Jul 2017, China will allow wholly foreign-owned financial services firms in China to provide credit rating services, and begin the licensing process on credit investigation and electronic payment services. Most importantly, China will issue both bond underwriting and settlement licenses to two US banks. The US is also expected to make concessions on Chinese banks’ operations in the US.

- Investment in US infrastructure to gain momentum and B.I.T. to continue negotiations

The US promises to attend the Belt and Road Forum this weekend, and will treat the direct investment from China the same as other countries. The collaboration on US infrastructure development is expected to be impelled by the 100 day plan.

* * *

Still, as Citi admits, in order to satisfy the US’s demand to increase exports to China and reduce the trade imbalance with China, many trade diversion practices could be enacted in the future. Given the China-US trade imbalance is structural rather than cyclical, reducing short term trade imbalances will lead to China purchasing more goods and services from the US at the expense of other economies.

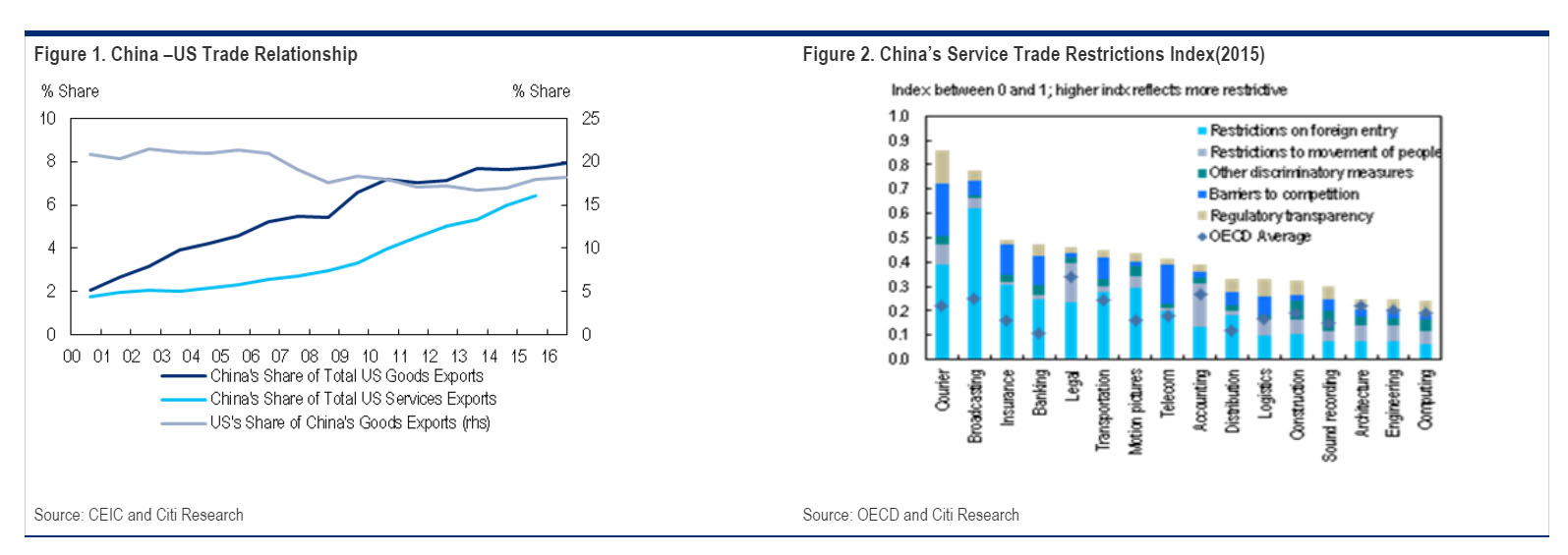

In addition, the toughest topics like dumping and government subsidiaries have not been discussed yet. Reciprocity means China would have to reduce many implicit trade barriers and beef up enforcement. This means China’s services sector will have to liberalise further for foreign participation (Figure 2). And while a trade war scenario appears to have been averted – for now – we need to wait for the final result of the 100-day plan in order to have clarity as to what kind of new Sino-China trade relationship will evolve.

While the agreement was nothing new for markets, political pundits also chimed in and according to Axios, which cites an intl trade expert, “the agreement is “underwhelming” and “mostly aspirational” — note the language: the U.S. “welcomes China,” China “may proceed,” the U.S. “recognizes,” the U.S. “remains committed,” and so on. This leaves a lot of questions as to what weight this agreement will ultimately hold.”

- For example: China will review eight pending U.S. biotech product applications that they have been on hold, but no guarantee to approve them…China will issue guidelines to allow U.S.-owned suppliers of electronic payment services to begin licensing processes. Again, this sounds like a win but the U.S. has already won a WTO trade dispute against China on these payment systems.

- Ending China’s ban on U.S. beef imports: Take this with a grain of salt. China announced in September it would end its ban on U.S. beef, but it didn’t amount to anything. The Chinese have been avoiding this move for years.

- Optics, including the U.S. recognizing “the importance of China’s One Belt and One Road initiative.” That’s symbolically a big deal, since Xi Jinping will want to tally some wins as he nears his five-year mark.

- finance: China will issue “underwriting and settlement licenses” to two U.S. financial institutions — which probably means a nice payday for two big banks in the U.S.

The pundits’ takeaway: “It’s a lot like Trump’s executive orders that talk a lot but didn’t do much,” according to the former U.S. official.

Hopefully this wont go anywhere. The Chinese should know not to let the camel’s nose into their tent lest his rump follows.

1 side is, that china for longer time prepared these steps. they need more and more gas, due to large financial bubble need financial services, and also need more flesh under teeth. thus, they moved these long planned steps, gave nothing fot america, for trump. but now trump can say in TV, i am the hero… of course, china will please and get something really from america. so is it for decades. thusm on the one side looks like similarly as this article wrote.

other side… miller, the cshief of gazprom told, the big gas project with china is dead.

so, america again gave check to russia.

finally, as i always told, tell and will tell, china is no friend for russia. china builds up the one belt, and will have bigger influence in central asia then russia. chinese never forgot, which territories took russia from them in the 19th century. and they want those territories back. the chinies think in centuries. zthemis enough, if get back in 50-80-100 years. for this reason they will be never friends with russia.

The big gas project with China is not dead. There are two huge projects of NG supply pipelines: the eastern route pipeline “The Power of Siberia” is agreed in total value of USD400Bln. during 30 years, and is under construction now; the western route pipeline “Altay” is still under negotiations, but in case of agreement, it will start work soon after the deal closed, as the pipeline is already exists on Russian territory.

While I agree that China is tough negotiator and “nobody’s friend”. But there are no “friends” in global relations, just partners only. And China is a partner, no dought.

i hope, you are right. i only put here what said the gazprom. rt news

I work as international trade analyst, and have finished my current report about gas deals with China few days ago:)

good :)

It may be a negotiation trick of Gasprom to make China be more pliable. RT is a provider of Russia’s strategical policy abroad.

China makes money not war