The last week saw some new developments especially in the field of rampant government debt. The US Fed finally made its decision about its interest rates, Standard & Poor’s downgraded Japan because of bad economic outlook and the Chinese stock market stabilized after turbulent weeks in the beginning of September. Meanwhile worries grow about the real state of health of the US economy while Ukraine is not keeping up with its schedule for restructuring national debt.

The US Federal Reserve keeps its interest rates at 0%. The much-anticipated announcement turned out as most economists had expected and most businesses had hoped for. The Fed will not increase its key interest rate and will keep monetary supply in the economy artificially high. The decision by Federal Reserve chief Janet Yellen reveals what the people in charge in the US do not want to hear: The US economy is propped up and being kept afloat only by the monetary stimulus of the central bank. The crisis of 2008 is far from being solved; rather it left millions of Americans in debt and jobless. The government debt is at an all time high reaching now over 96% of the GDP. It remains a mystery as to why the US still has a credit rating of AA+ when the outlook is so bleak. It is a highly accepted thesis among economists that the US is trying to save itself and its economy with the highly criticized and unpopular trade agreements, like TTIP and NAFTA, currently undergoing secret negotiations. One knows for sure that money is tight in the US when the president orders military cuts and a reduction in total number of troops, a previously untouched sacred cow.

The markets are starting to get worried about the US economy. Oil saw its sharpest drop in three weeks after the Feds decision. “Oil prices generally don’t benefit from uncertainty or instability, so this price reaction is most understandable,” Jeff Born, a professor from the D’Amore-McKim School of Business at Northeastern University told marketwatch. Gold jumped $20.80 amounting to a total of $ 1,137.80 an ounce on Comex. The gold price is mostly negatively correlated to the dollar meaning it works as a kind of hedge. Whenever the US economy gets in trouble or inflation fears rise, the price for gold goes up because the market increases its asset allocation in gold to make the portfolio crisis proof. Meanwhile the Chinese ministry of finance doubts the stability of the US economy and declared that they are skeptical about its recovery.

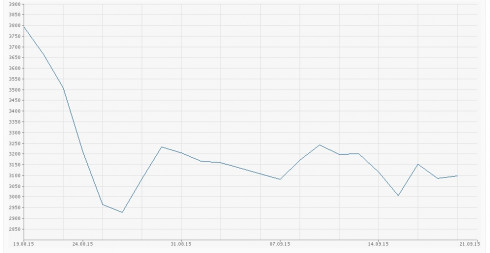

China continues to hold its market-stabilizing rules intact. The measures were taken after the Shanghai Composite Index dropped 40% after its peak in June. The policies prevent shareholders, corporate executives and directors who hold at least 5 percent of a company’s shares from selling stakes for six months. Since then the policies have already shown some effect, mitigating the initial drop to around 35% and stabilizing the Yuan exchange rate. Meanwhile investigations into 5 cases of alleged market manipulations have begun. The detained, among them high-level executives, are accused with spreading fake information about the markets leading to panic sales. The woes on the Chinese stock market led to strong fluctuations on international markets and forced the Chinese government to intervene and prop up its economy by selling US-government bonds, much to the disapproval of the American administration.

S&P downgrades Japans credit rating due to unavoidable economic slowdown. The US-based rating agency has downgraded the Japanese credit Rating from A+ to AA-. Standard & Poor’s explained their move with the economic slowdown that they expect to last over the next three years. All three major US rating agencies see Japans enormous debt as problematic. The Japanese debt has increased over the last year despite an increase in national sales taxes. S&P sees the aging and shrinking Japanese population as the reason behind the slowdown and debt increase. It remains speculation whether the US will stage a major crisis in Asia to create a flow of refugees to prop up Japans demographic outlook like it currently does with Europe.

Ukraine’s debt crisis is worsening. The restructuring of the Ukrainian debt is not going according to plan. In order to get a new IMF-loan of $17,5 billion Ukraine would need to restructure some of its old loans. The option that Kiev prefers the most is a debt haircut, which means that the creditors write off a certain amount thus lowering the total outstanding debt burden. A group of bond holders represented by the law-firm Shearman & Sterling announced that it would block the restructuring deal, Bloomberg reports. This is in line with the Russian stance that previously refused to accept such a haircut. In the meantime, Ukrainian bonds denoted in Hryvnia are becoming more and more worthless since the countries currency has plunged since the beginning of the riots on Maidan.

National debt continues to plague particularly the countries entangled with the financial system of the West. The US government is not succeeding in silencing the rumors about its ailing economy. Instead the Fed blames China for its nervous financial markets. It looks like the current situation on global markets is not half as stable as commentators would like us to think. Instead it is likely that the future will hold more debt related problems that are additionally fueled by sanctions that contradict economic logic.

japan only took 11 refugees in 2014 so a ”flow of refugees to prop up Japans demographic outlook ” is the most stupid statement in this story