Bank of America is ignoring facts and arguing that Russia is near to default.

This article originally appeared at Topwar.ru, translated from Russian by Olga Seletskaia exclusively for SouthFront

One of America’s leading financial organizations – Bank of America – submitted a list of countries whose economies are, according to experts of the company, are closest to the default. Before taking a closer look at the economies identified by Bank of America (BAO) as the most close to the default, it should be noted that the same financial institution announced the most stable economies in the world.

Surprisingly, economies of US and Japan were rated as the most stable ones, though total public debt of these countries exceeds 27 trillion dollars! Japan’s public debt itself exceeds 225 % of GDP! Hence, in the most ” stable economies of the world ” every citizen (in Japan – every subject to the emperor) carries an average debt of about 40 thousand dollars…

Besides the United States (that is ruthlessly using the printing press to print more money) and Japan, in the same list of “most stable” economies are: France (public debt is more than $ 2.1 trillion), the UK (public debt of $1.1 trillion), Germany ($2.6 trillion), and several other countries (Australia, New Zealand). Apparently, according to the rating, indicators of “the great stability” are such “economic factors” as: the presence of the printing press which never stops money printing, a some-trillion-dollar national debt, and, most importantly, – to keep pace with the US “friends” (to be part of the Anglo-Saxon “pool” ), possibly offering their national territories to place more American military bases.

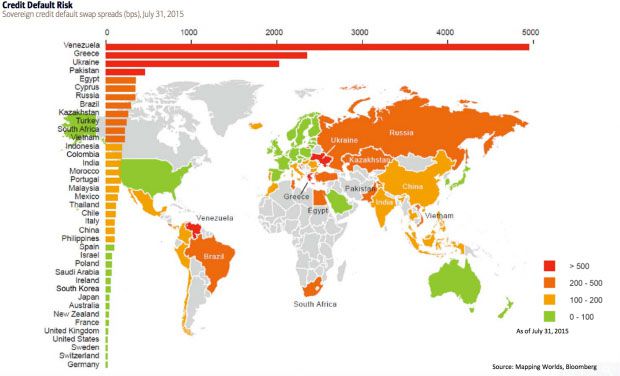

What are the most risky economies, according to Bank of America? The top three are as follows: Venezuela, Greece and Ukraine. Taking into account that the “rating” was done by American experts the list of risky economies looks pretty fair… But here is a question: why is Venezuelan economy estimated as being closer to default, than the Greek economy, given that the South American state debt is under 35% of GDP, and public debt of the Greeks is moving by leaps and bounds towards 300% of GDP? American experts reason that the Venezuelan economy is closer to default than the Greek or Ukrainian (despite the fact that Venezuela has huge reserves of high-quality hydrocarbons) because the public debt of Venezuela is “more risky”. Bank of America said that insurance costs for the Venezuelan debt is almost twice expensive for Western insurance companies than insuring the Greek debt. In other words, there is a blatant pressure “from above” on the insurance companies to assign different debt insurance rates for different countries. Because if there were no pressure with political overtones on insurance companies from the West (namely, from the USA), it would be hard to explain why debt of the country, which is the eighth in the world oil production, is more risky than debt of the country which is torn apart by civil war, whose debt is approaching 90% of GDP, and whose GDP decline is estimated at 16.5 % per year (the Ukraine). It’s like the situation with the expectation of repayment of the two neighbors from the same apartment building. The first works and earns (maybe not as much as is necessary in order for the full repayment of the debt); and the second does not stop drinking since February 2014, wrecks his apartment, continues to beg for money from every single resident of the apartment building and declares that he has to fight with imaginary “cockroaches and flying dogs” … What case is more risky here? .. Following the US bank logic, the case of the working and making money neighbor willing to pay the debts is more risky… Really? ..

It is interesting to note that the economy of oil-producing Saudi Arabia, whose dept/GDP ratio is very similar to Venezuela, is rated by BOA as one of the leading economies. In other words, the two economies that get their income almost entirely from the sale of hydrocarbons, whose debts in a percentage are roughly equal, are placed by the Bank of America in a diametrically opposite ends of the list. And Venezuela is constantly reminded that if it makes a step in a wrong direction, the economic default will be pronounced……

American “independent” rating does not end there. Russia’s economy is on the 7th place in the list of Bank of America, at the level close to default . Yes, yes … right next to Cyprus. It is when the Russian government debt is at 17 % of GDP, and the country has a reserve fund, which size is comparable to a half of Ukraine’s economy … Well , Russia does not have a non-stop money printing press, Russia is not on the US’ friends list; and hence, Russia is being told: here is our rating – your economy is close to default….

This rating is quite predictable, taking the fact that such a rating-”cooking” is carried out in the dungeons of the economic financial institutions that have long been solving their own problems while claiming being credible and unbiased … Yeah …

To be completely convinced in the “unbiased” and ” credible” rating by the US bank, it is worth to look how China is ranked. In the chart, China is in the yellow- orange zone, which means that it is “close to default” – not, as close as Venezuela, but still close to …

Default in China, which national debt is not even 10 % of GDP ?! Default in China which is overtaking the US in terms of GDP volume?! Oh, those jokers in Bank of America … Well, of course they have to please those who pay for this “coo-coo” rating; and we are aware that Russia, Ebola, Assad’s chemical weapons , and Venezuela and China are the main threats to progressive humanity, but BOA went way too far this time …

In China, however, nobody laughed or got angry with the rating; but, as a “present” to the raters, China has lowered the average rate of its national currency (the yuan) by about 1.9% against the US dollar. 1.9% is seemingly insignificant compared to broad swings of ruble in one or another direction … But the 1.9% is exactly the value that makes the United States with their ratings “dance as sinners in the frying pan” – Chinese products overcome new levels of competitiveness and, therefore, they shall afflict European and American products in world markets.

And given the fact that the China has long explained to Washington in a diplomatic way, how “seriously” they view American ratings and lists, Russia should make every effort to create its own rating and other financial and evaluating agencies to provide investors with a really objective information on the economy status.

Defaulted, you say? Oh well…