The last week has seen a halt in the decline of oil prices once the news got out that Russia and OPEC were in talks about reducing oil production. Furthermore, China has warned George Soros against massive speculation against the Yuan. Meanwhile India and Russia have reached an agreement about the costs of the joint development of a fighter jet. Finally the IMF adjusted its quotas which regulate how much votes every country gets in the decision making process.

Wirten by Frank Jakob exclusively for SouthFront

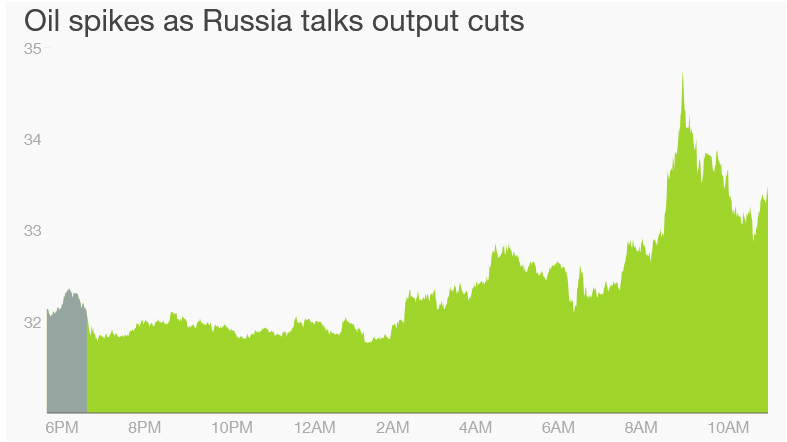

Russia and Opec discussing 5% oil production cuts. Russian Energy Minister Alexander Novak told Russian state news agency TASS on Thursday that OPEC and non-OPEC producers were considering a 5% output cut. However, Novak cautioned that no definite agreements have been reached so far and that it would be “too early” to be making definite statements. One of his spokespersons told CNN that there is no formal date for the meeting yet but that it’s most likely to be taking place in early February. The announcement has been made amid a recent decline of oil prices towards historic lows with the barrel of oil dropping towards the 30$ barrier. The oil price reacted directly to the rumors of the imminent production cuts.

China warns Star-Investor George Soros of betting against the Yuan. George Soros has recently voiced concerns about the status of the Chinese currency and its stability. During a keynote of the World Economic Forum in Davos he said he was convinced that the slow-down of the Chinese economic growth was responsible for the current bear market. “A hard landing is inevitable” he was quoted in an interview with Bloomberg about China. “I’m not expecting it, I’m already witnessing it” he went on. China’s state news agency responded instantly to his remarks and stated that every speculation against the Chinese currency was doomed to fail. Attempted speculation could also cause a legal response. Analysts expect that a decline of the Chinese currency would not necessarily cause big damage to the countries economy, rather it would harm mostly China’s neighbours. Soros was successful in bringing down the British pound due to a massive speculative gamble against the currency, which resulted in the exclusion of the pound from the European currency basket.

India and Russia to invest $8 billion into the development of 5th gen fighter jet. The Indian Air Force (IAF) and Russian manufacturer Sukhoi have agreed on developing an Indo-Russian 5th Gen fighter aircraft (FGFA). The investment costs for each country were set to $ 4 billion. The deal is aimed at producing 250 FGFAs to replace the Sukhoi-30MKI multirole fighter already in Indian service. Meanwhile India is still negotiating with France over the purchase of 36 multirole Rafale fighters. French president Hollande is set to arrive in New Delhi on Monday for further talks on the matter.

BRICS to have more influence over IMF decisions. The IMF has raised its quotas for the fast growing countries. Together the BRICS will now hold 14,7% percent while the US alone still hold 16,7%. The BRICS therefore have a veto right which requires 15% of all the votes. Even though they are slightly below this line it shouldn’t be very hard to find a likeminded partner to reach the full 15%. This change means that Russia, India, Brazil and China are among the ten biggest members of the IMF for the first time in the history of the organisation. This means that the West can no longer push through any decisions that go against the interests of the BRICS due to this newly acquired veto right.