The price of oil has not significantly increased on Monday, despite the new tensions in the Middle East. The reason: The reserves are filled to capacity. This development could motivate Saudi Arabia or other petroleum producers to further escalate the situation. The first signs can already be seen in Libya. The development will lead to new expulsions and worsen the refugee crisis in Europe.

Originally appeared at DWN, translated by Karin exclusively for SouthFront

On Monday prices fluctuated violently at the oil market. The calculation of the Saudis was actually that the tensions in the middle East would result in supply shortages. Indeed, the dispute between Saudi Arabia and Iran should make any cooperation within OPEC – both countries belong to the cartel – improbable. The oversupply of oil had caused prices over the past year to fall by 35 percent. While the price of North Sea Brent crude oil rose on Monday temporarily up by 4.6 percent to $ 38.99 per barrel (159 liters). But the quotation, thus remaining within easy reach of the financial statement established on New Year’s eleven year low of $ 36.10. In the evening, Brent traded at again around $ 37.

Saudi Arabia staggers on the brink of national bankruptcy because of low oil prices. The Islamist theocracy urgently needs a higher oil price. For fact only a significant rising of oil prices can keep the system in Riyadh from facing a serious threat.

Consequently Riyadh is unapologetic: Saudi Arabia has defended the controversial execution of 47 people accused of terrorism-allegations. The accused have had fair and equitable lawsuits regardless of their religious affiliation, it said on Monday in a statement of the Saudi Arabian representative to the United Nations (UN). The kingdom deeply regrets that UN Secretary General Ban Ki Moon has expressed concern about the allegations against the delinquents and the processes.

This diplomatic note was all that was heard from Riyadh. Because the Saudis have big problems to keep their sources of income effervescence. The tensions between Saudi Arabia and Iran are hurting the kingdom financially. Even so the Riyal is pegged to the dollar, at the futures markets its course has fallen. The so-called dollar / riyal forward shot up by a good 36 per cent and was with 680 points only 50 points below its 16-year high in December.

This rally is driven by speculation on a decoupling of the Saudi currency from the dollar, said Guillaume Tresca, a specialized investment strategist of emerging markets of Credit Agricole. “With the decline in oil prices, these fears have increased. The market expects a depreciation of three to four percent.” Because of the global overproduction the price of the single most important Saudi export crude oil, has fallen over the past year and a half by about two-thirds.

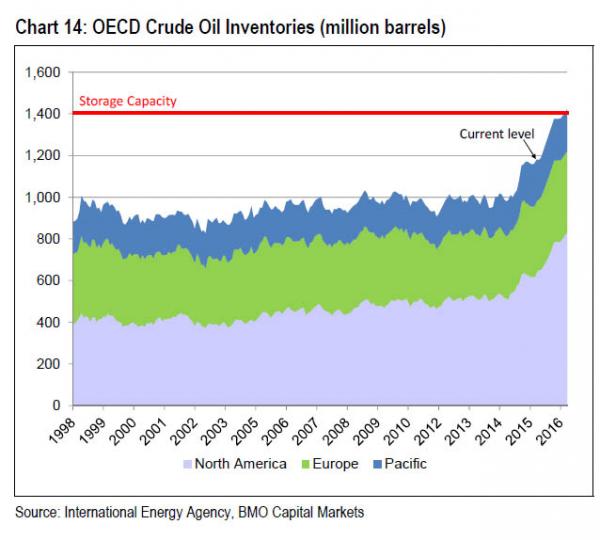

Stocks worldwide are at a record level – and it’s the biggest problem for the Saudis. A Bloomberg survey showed that market participants expect the full reserves in the United States will in the foreseeable future to be 130 million barrels above the five-year average.

Basically a strong relief for the Saudis can only succeed if the situation in the Middle East continues to escalate. A first signal the Saudis had sent at the weekend towards Yemen: They announced the termination of the very difficult reached from the UN negotiated cease-fire and are hoping to be able to pull Iran deeper into the conflict.

However, Tehran is in a relatively favorable position: Because of the lifting of sanctions, the Iranians will enter again into the oil business. This will continue to have a negative impact on the oil price. The with the Iranians allied Russians have no intention to reduce the output rates. Moscow speculates on being able to hold out longer than the Saudis.

Another indication of escalation happened on Monday in Libya: The Terror Militia IS is preparing to conquer the oil port Es Sider and to bring for the first time an oil facility in the North African country under their control. In battles with the so-called Islamic state (IS) two guards were killed, according to Reuters eyewitness and a representative of the protection teams who guard the facility, reported on Monday. An oil storage had been hit during the fighting by a missile and was in flames. Two suicide bombers of the IS had cars stocked with explosives driven into the controlled area of the port.

The oil terminal at Es Sider and the neighboring Ra’s Lanuf are closed for more than a year due to power struggles in Libya, after the by the US brought overthrow of President Muammar Gaddafi in 2011. The recent renewed fighting around Es Sider, beside the conflict between Saudi Arabia and Iran, nevertheless drove up the oil price in the beginning of the week, consequently speculated by Reuters.

The oil-rich country is threatened more and more to sink into chaos. Two governments compete for dominance, several militias fighting each other. Es Sider is protected by the militia of the former rebel leader and Gaddafi opponent Ibrahim al-Dschathran, who supports the Western-backed and recognized government.

But his militia fights also against groups that stand as well behind the Western-oriented government. This power vacuum is used by the IS to it’s advantage. Extremists threaten to advance further from Sirte. So far they haven’t brought an oil facility under their control – unlike in Syria. The IS-militia is claiming to have taken control over the city Bin Jawad, located near Es Sider. However, an independent confirmation of this does not exist.

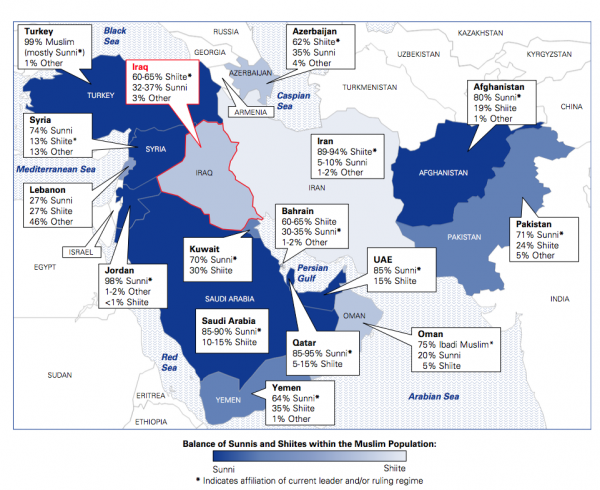

It is difficult to assess who exactly is behind the activities of the IS in Libya. A fact is that Saudi Arabia has always supported the IS with weapons and financing. The development in Libya could be a model example of how regional military conflicts affect the oil markets, without having a big war between Iran and Saudi Arabia. The conflict can be stoked basically at will between Shiites and Sunnis. A map of Goldman Sachs shows very clearly how fragile the situation in the Middle East is, when viewed from the standpoint of a religious civil war:

The distribution of Shiites and Sunnis in the Middle East. (Graphic: Goldman Sachs)

One consequence of this struggle of the giants for existence will in any case be the fact that there will be further expulsions. The refugee crisis is therefore not only not resolved in the coming months, but will be intensified. The relevant consequences for Europe are foreseeable because of the confession of Angela Merkel to keep open borders.